Global Messaging Engagement Report

Learn how global customers prefer to communicate with brands.

Every year, Twilio SendGrid surveys consumers worldwide to understand how their attitudes toward email and SMS evolve. This year, we surveyed over 4,800 consumers across six countries—Brazil, France, Germany, Japan, the UK, and the US—to determine if traditional communication channels, like email, remain consumer favorites or if newer channels like social media and webchat are gaining popularity.

In this year’s report, we delve deeper into the shifting communication preferences across the globe and in the six countries surveyed. These data points and insights will help your business stay informed of emerging trends and consumer behaviors so you can update your email and SMS strategies accordingly.

Before we dive into the key findings, let’s take a brief look at our survey methodology.

To better understand consumer email and SMS preferences, we conducted a quantitative online survey and qualitative ethnographic study with 4,800 global consumers, featuring:

800 respondents from six different countries: Brazil, France, Germany, Japan, the United Kingdom (UK), and the United States (US)

200 individuals from each of the following age groups: 18-24, 25-35, 36-50, and 51-65.

Each respondent completed a 26-question survey about their daily email and SMS usage and branded communication preferences. From preferred message frequency to common inbox frustrations to purchasing behaviors, the valuable consumer insights in this report will help your brand develop a more targeted regional customer messaging approach.

Here are a few overarching trends we noticed across all six countries surveyed this year:

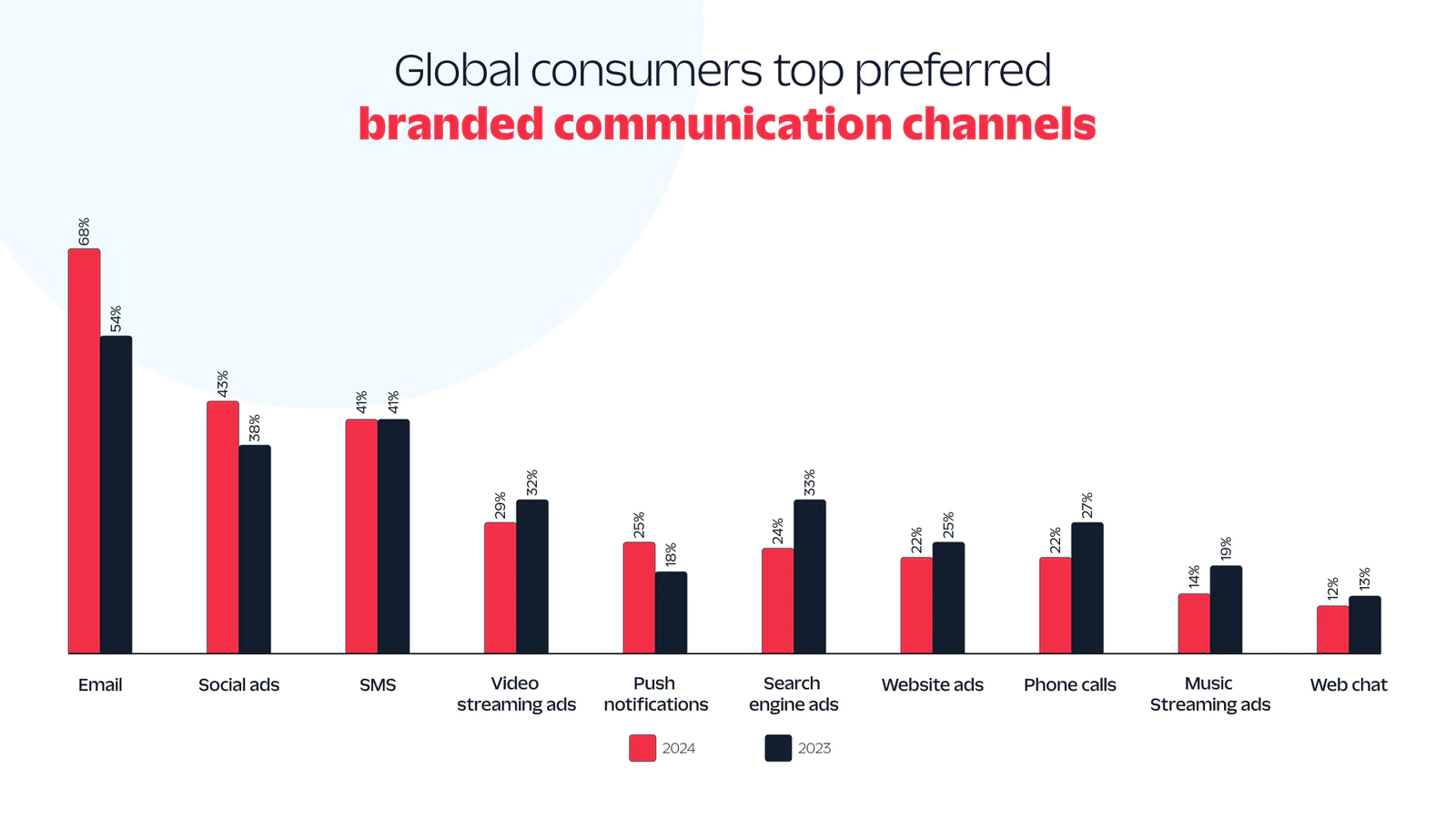

Over the last four years that we’ve conducted this survey, email has remained the most preferred branded communications channel among global consumers. This year, 68% of respondents ranked email as one of their top three preferred channels for brand communication—up from 54% last year.

One notable change since last year is the rise in popularity of social media ads, which have pushed SMS/MMS to third place for the first time in our survey's history. Although the two channels remain close in popularity, social media ads edged out SMS with 43% of global consumers listing it as a top-preferred channel, compared to 41% for SMS.

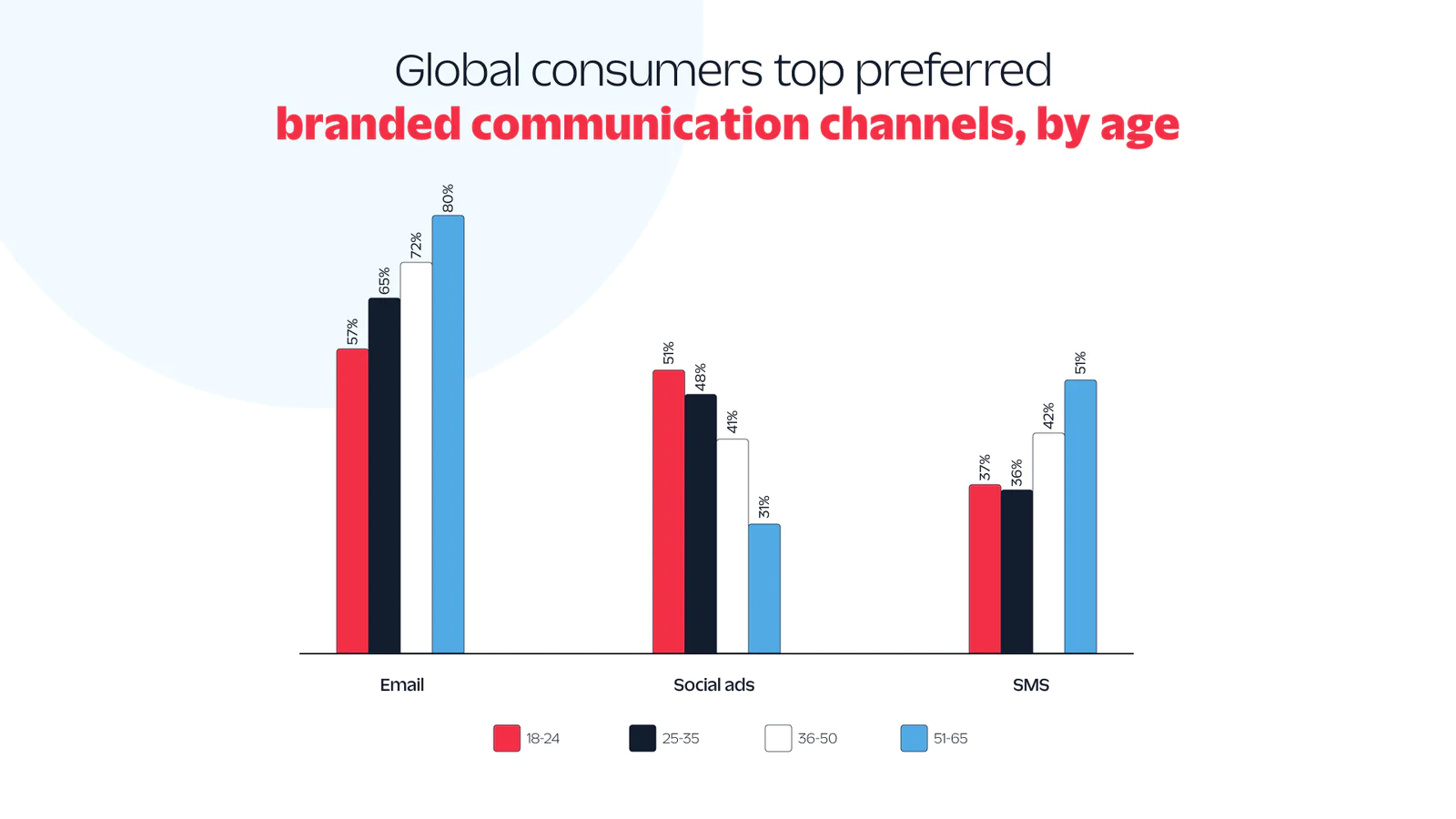

While email and SMS are more popular amongst older consumers, social ads are valued by younger generations. Because of this, marketers should adopt a multi-channel strategy that caters to the preferences of different age groups. By combining personalized email and SMS campaigns to engage older consumers with targeted social media ads to attract younger audiences, businesses can effectively connect with all demographics and optimize their marketing efforts for maximum impact.

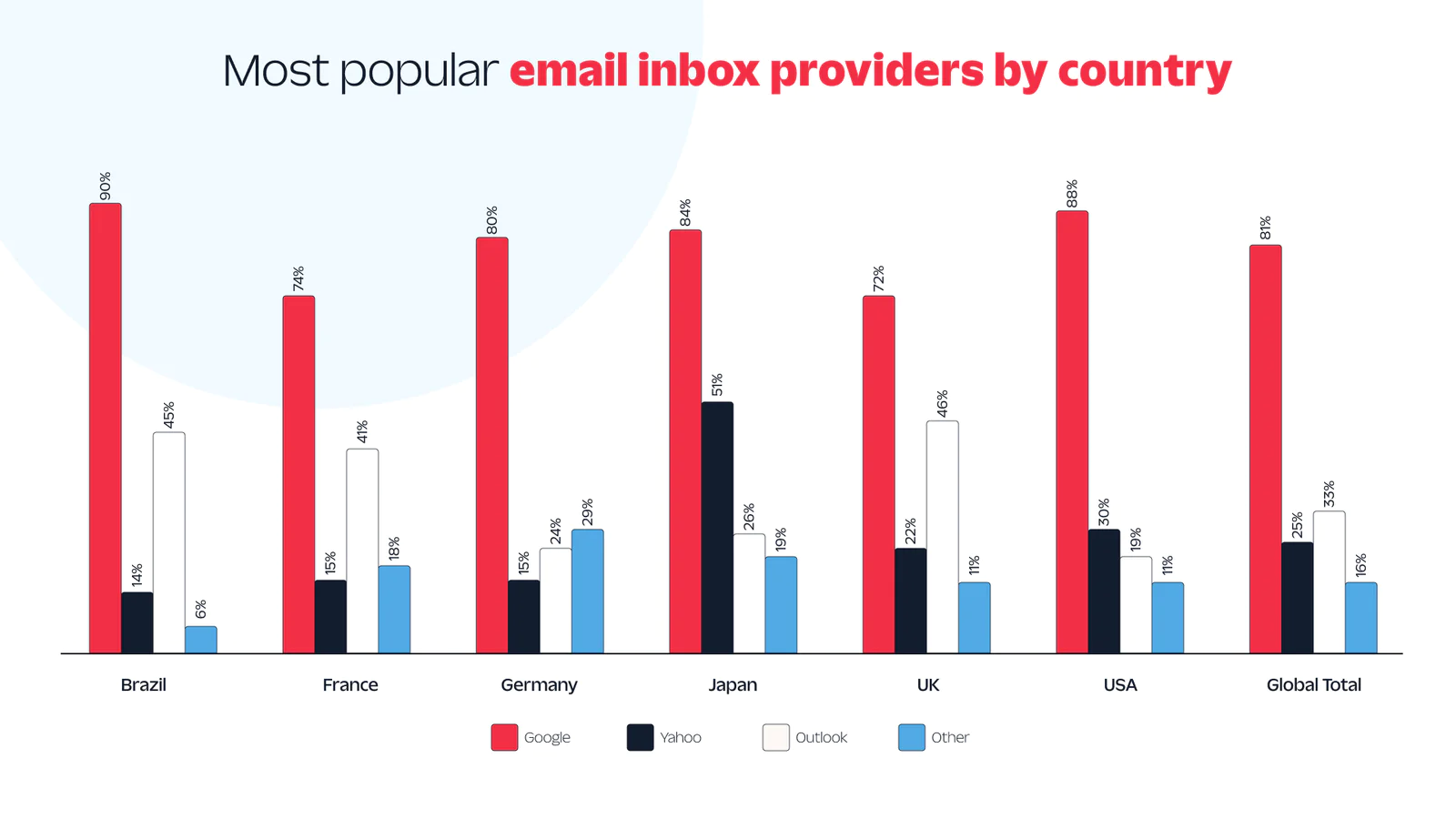

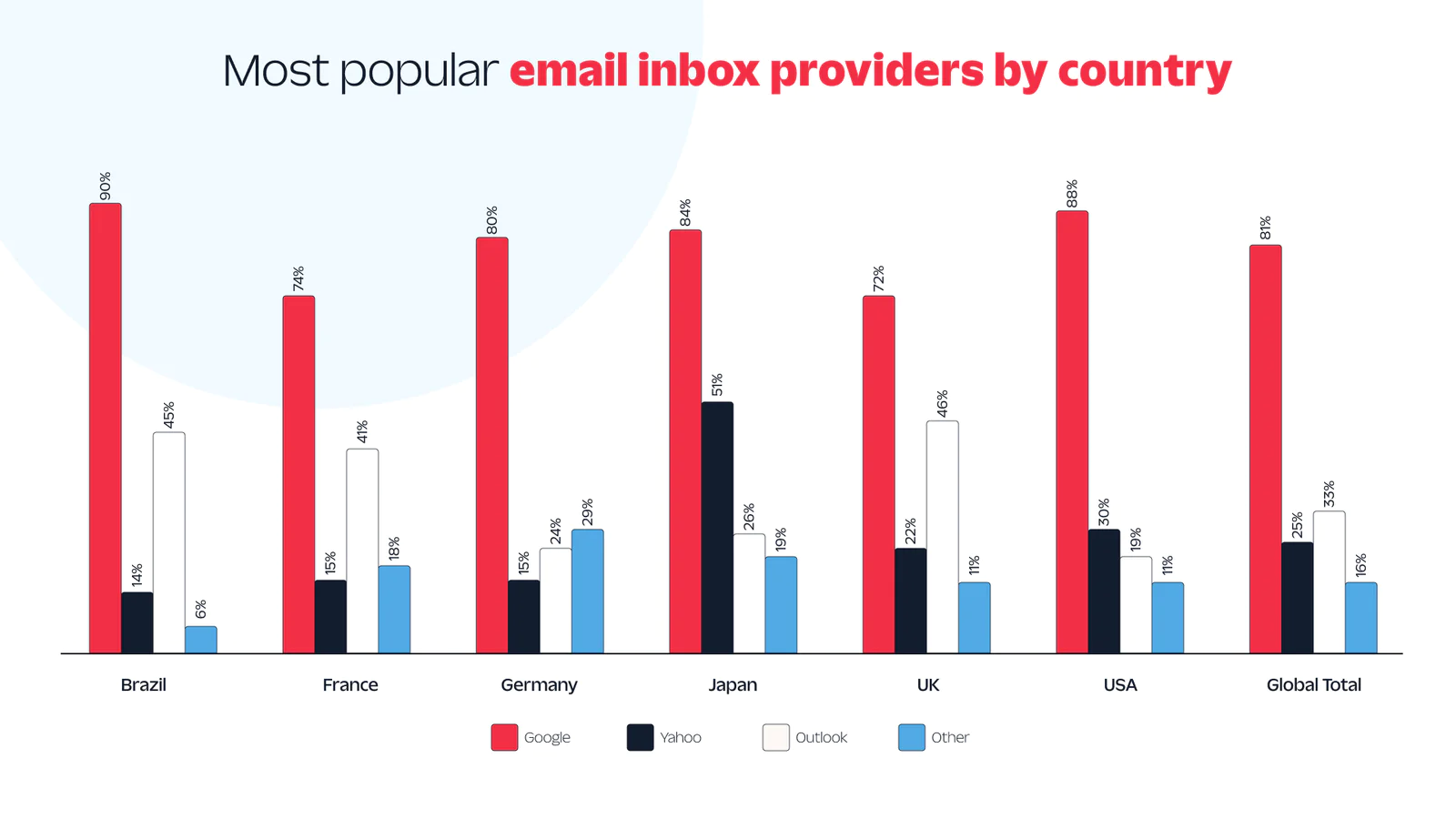

We asked consumers to share which inbox provider(s) they use to better understand which platforms dominate the market and how consumers interact with email across different services. While 29% of global consumers have just one personal email address, 71% use more than one, so keep in mind that consumers may use multiple platforms.

Our findings revealed that Google is by far the most common consumer inbox provider worldwide. That said, Yahoo is more popular in Japan, and the same can be said for Outlook in the United Kingdom, France, and Brazil. With new Yahoo and Gmail sending requirements, it’s wise to stay updated on the inbox providers your customers are using to maximize deliverability and ensure all your messages reach your intended recipients.

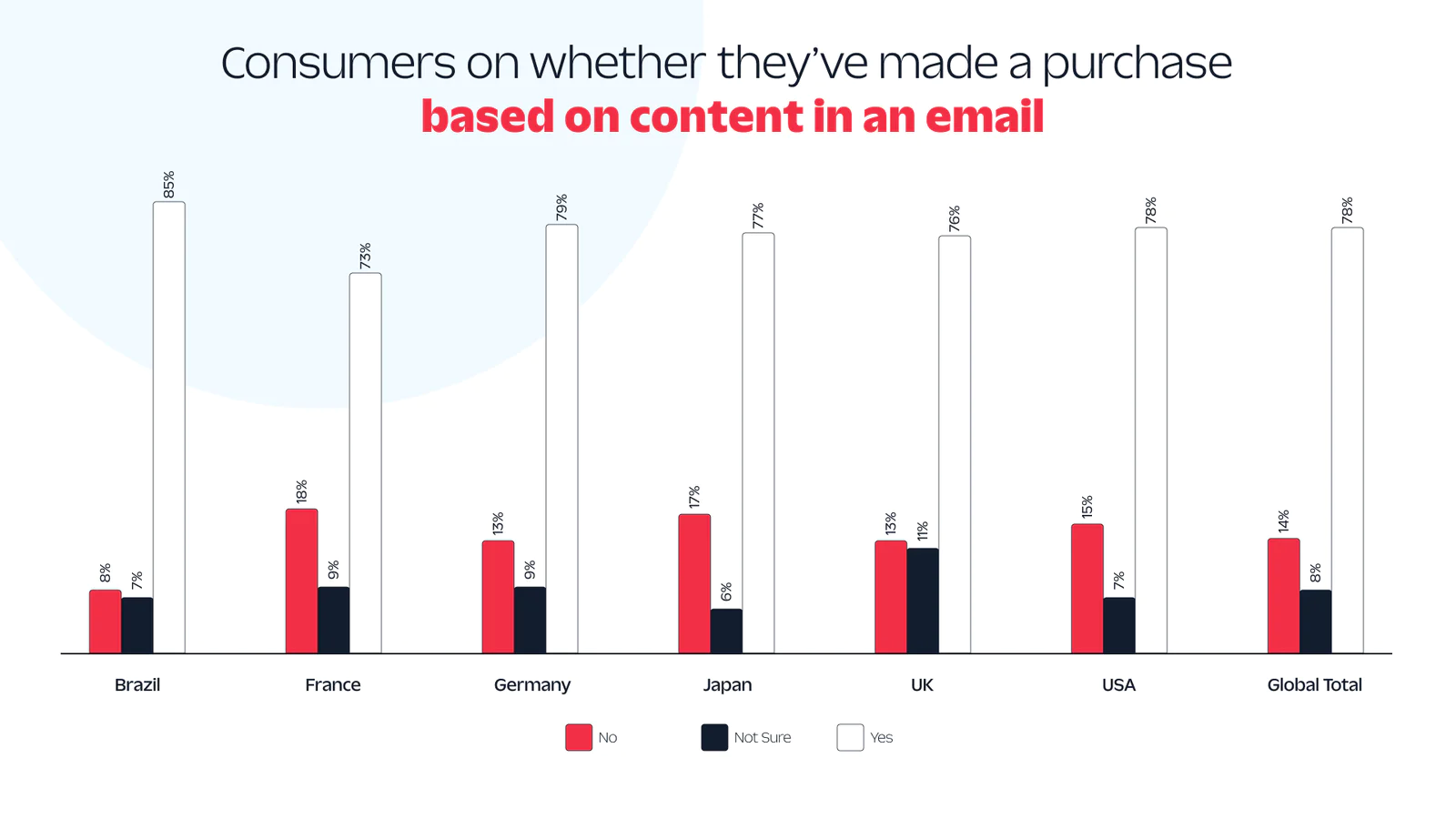

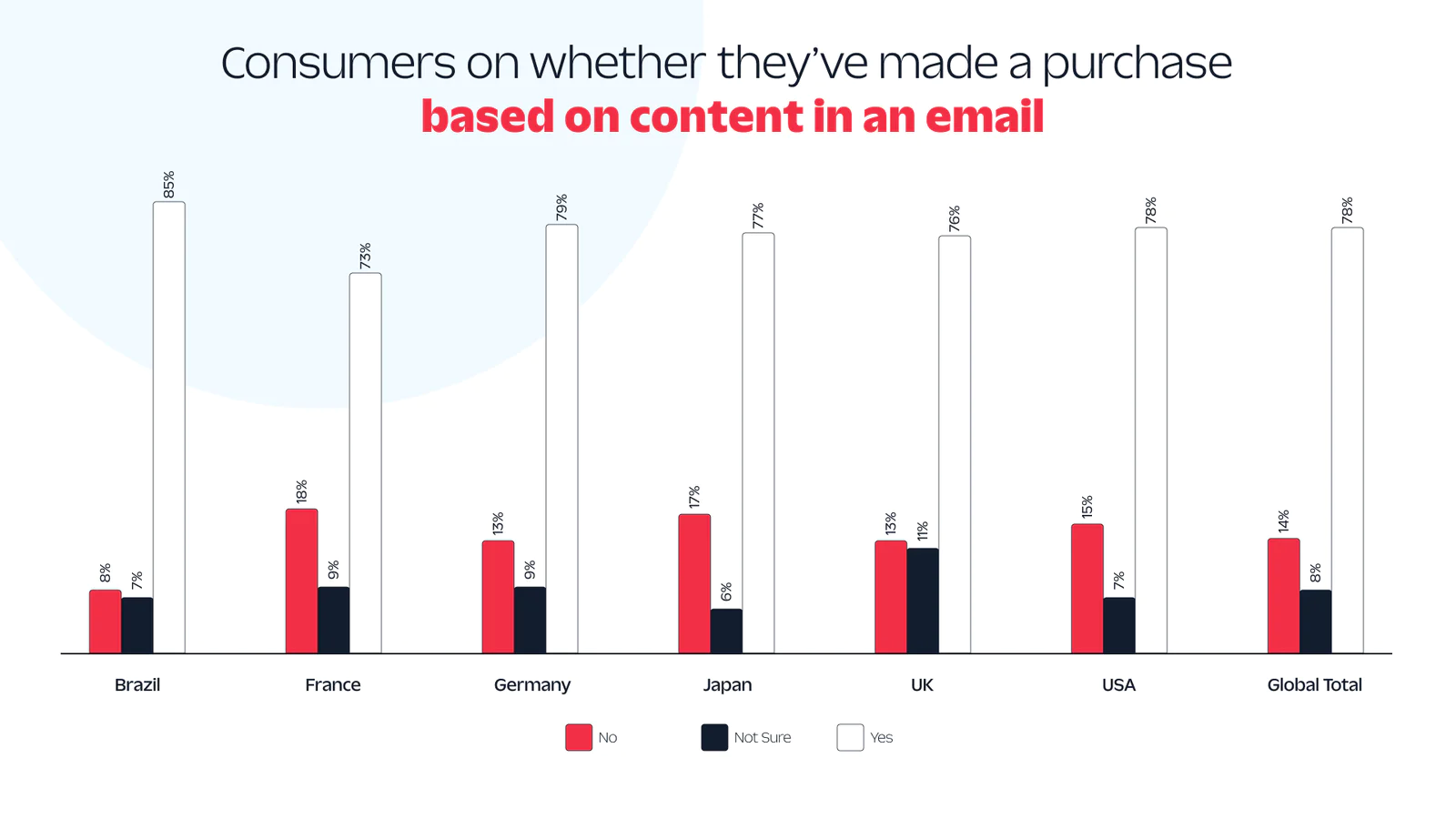

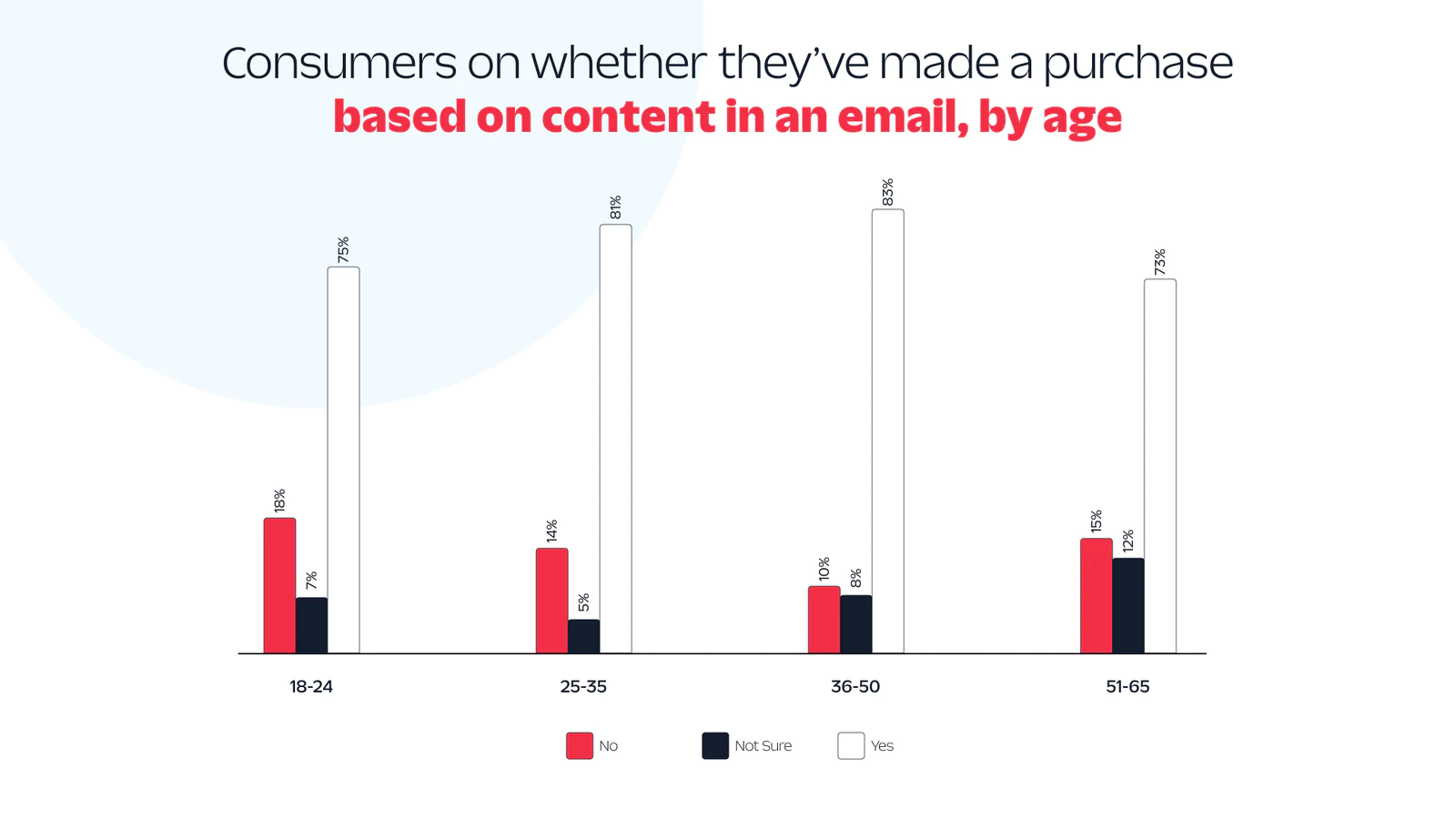

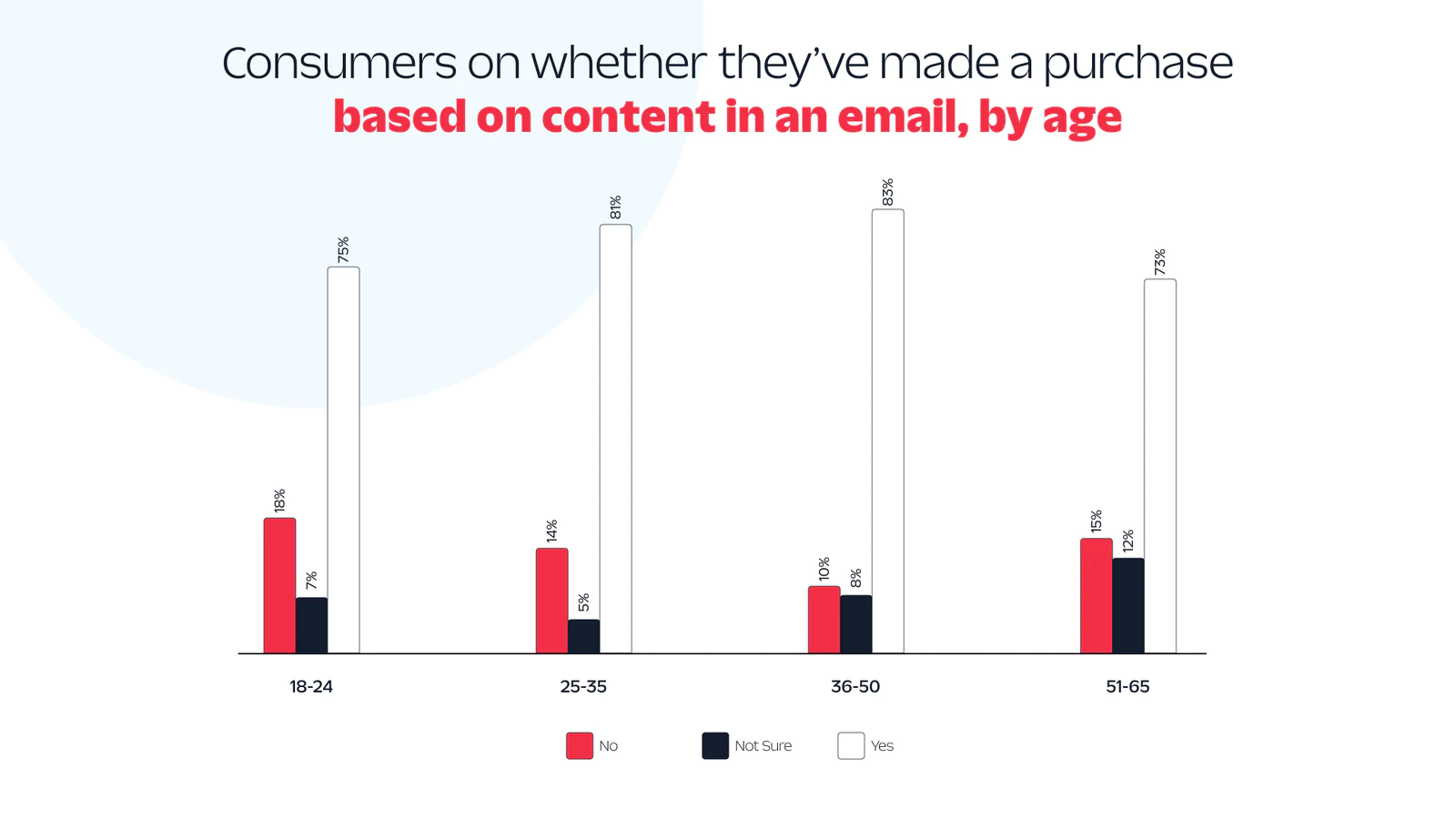

This year, 78% of consumers said they’ve made a purchase from an email. While that’s not a big change compared to last year’s result of 77%, these figures prove that email is still a powerful marketing channel that drives revenue.

Curiously, consumers aged 25-35 and 36-50 were slightly more likely to make a purchase from content in an email than their older and younger constituents. Of all age groups, the youngest respondents were more likely to reveal they’ve never been influenced to buy from an email message. Even so, three out of four consumers aged 18-24 say they’ve bought something from an email, so it’s still a worthy investment even if your audiences skew younger.

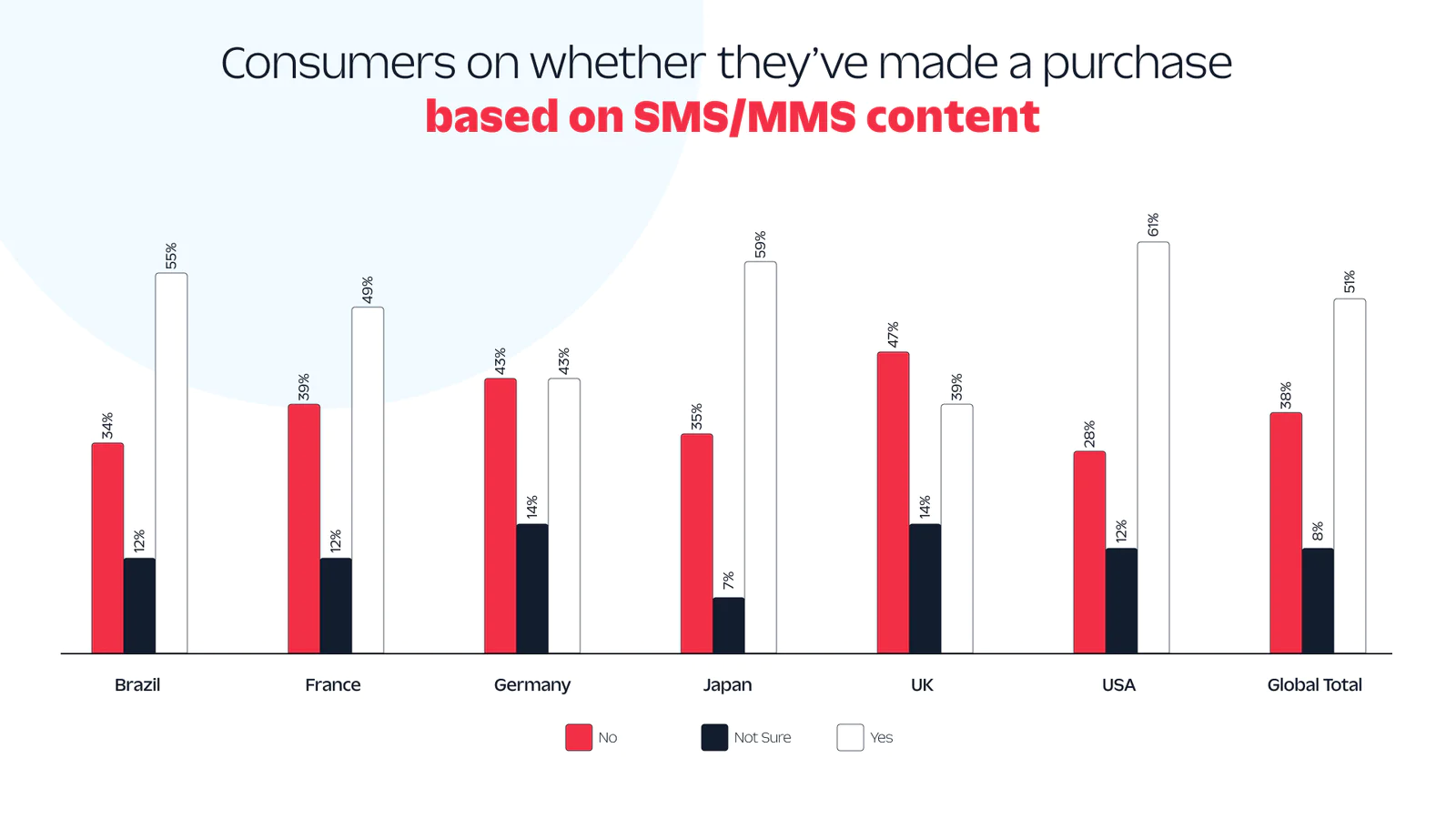

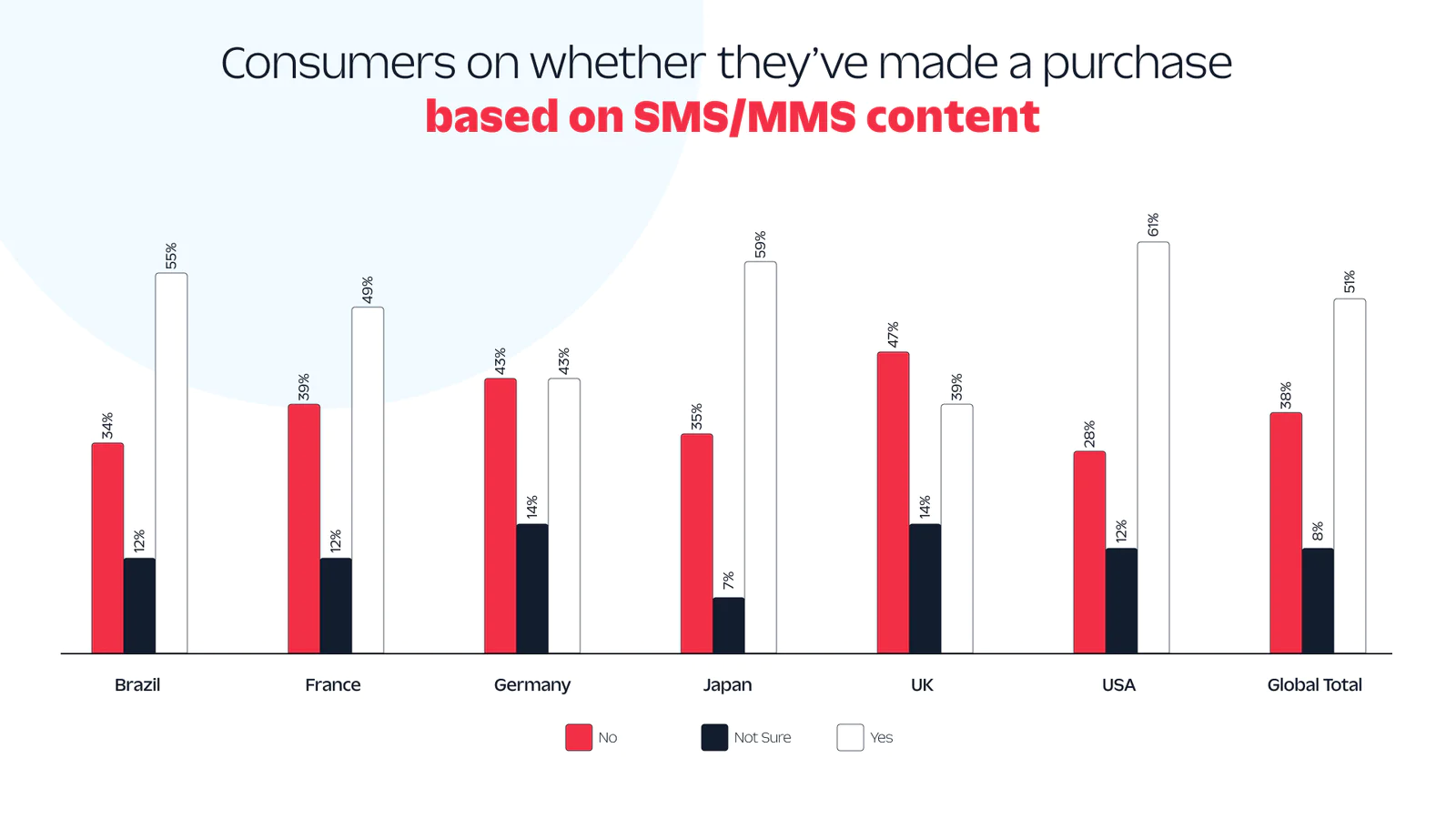

In the first four years of our survey, we focused solely on consumers’ email purchase behavior, but this year we expanded the survey to also inquire about their SMS behaviors. Interestingly, only 51% of consumers say they’ve made a purchase from a text message, which is to be expected given that email offers a more visual, long-form medium compared to SMS/MMS.

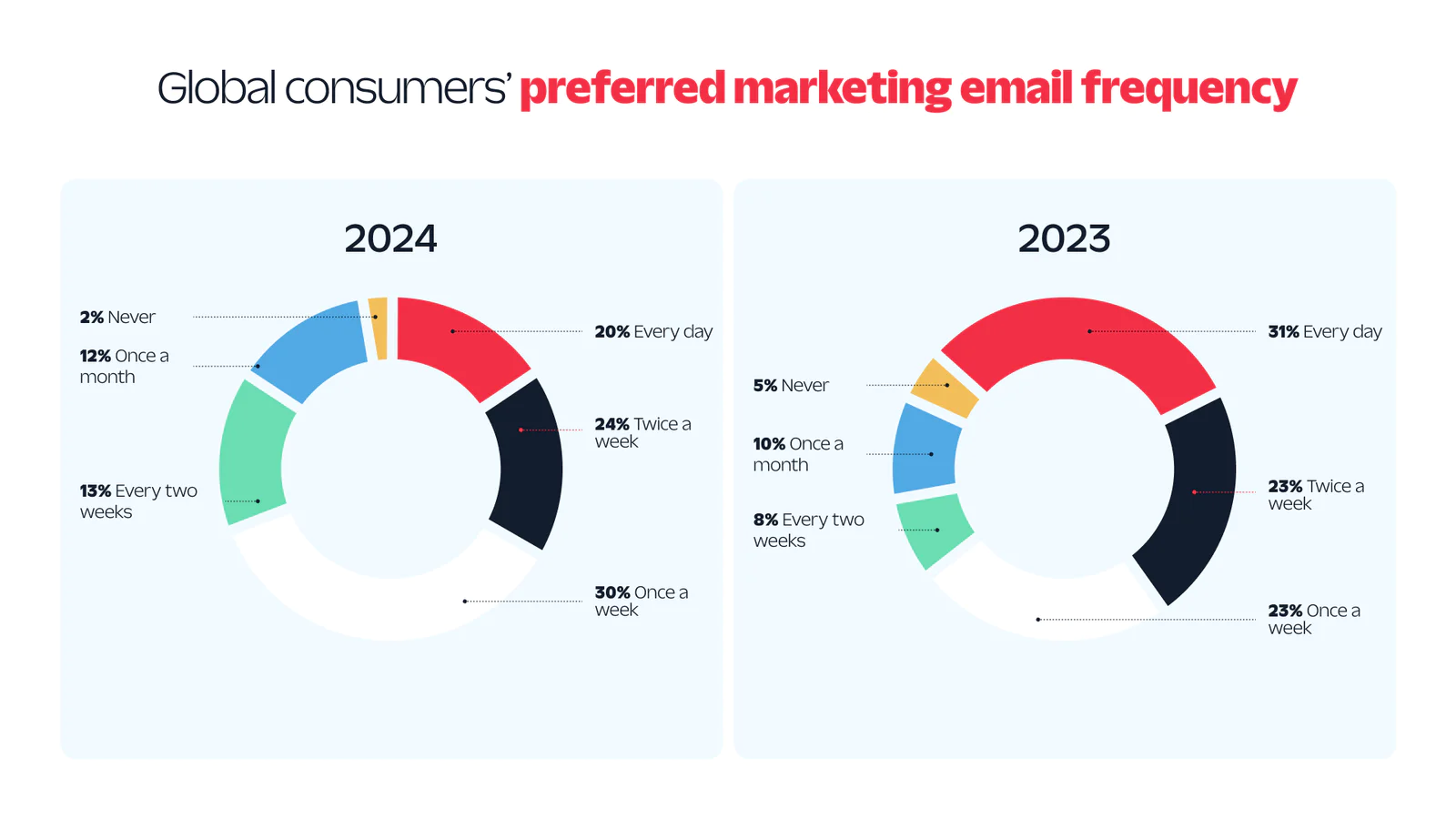

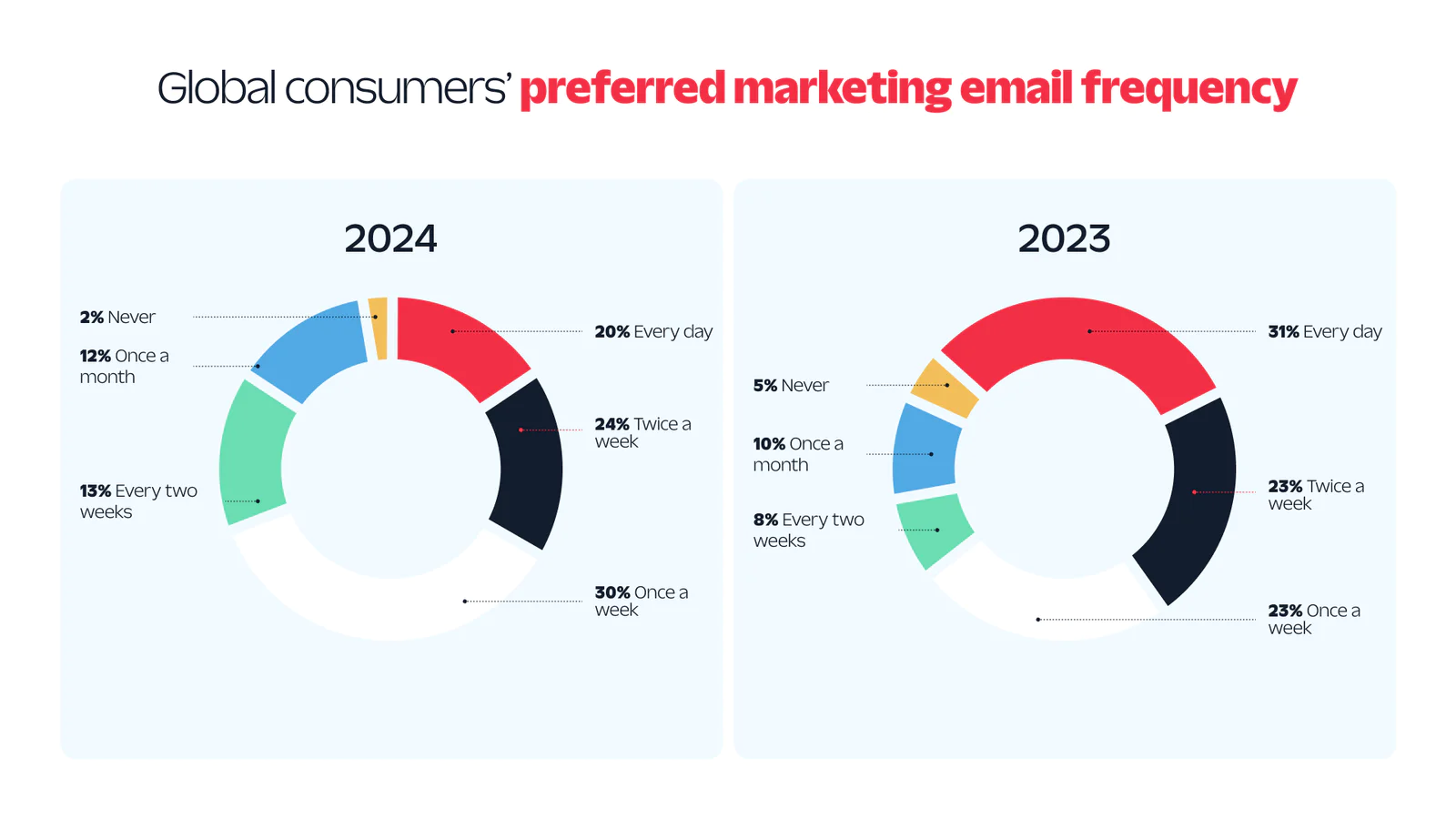

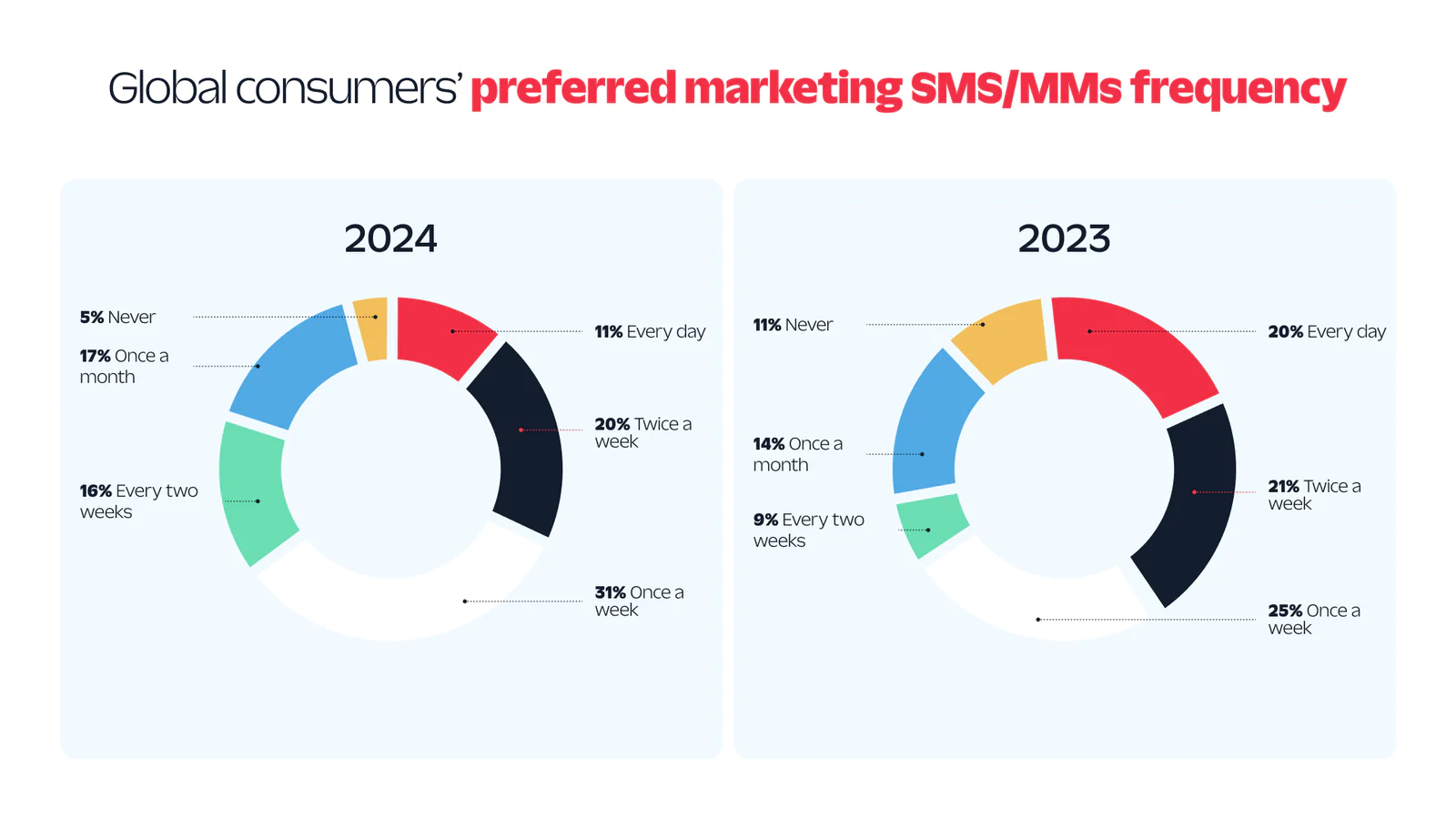

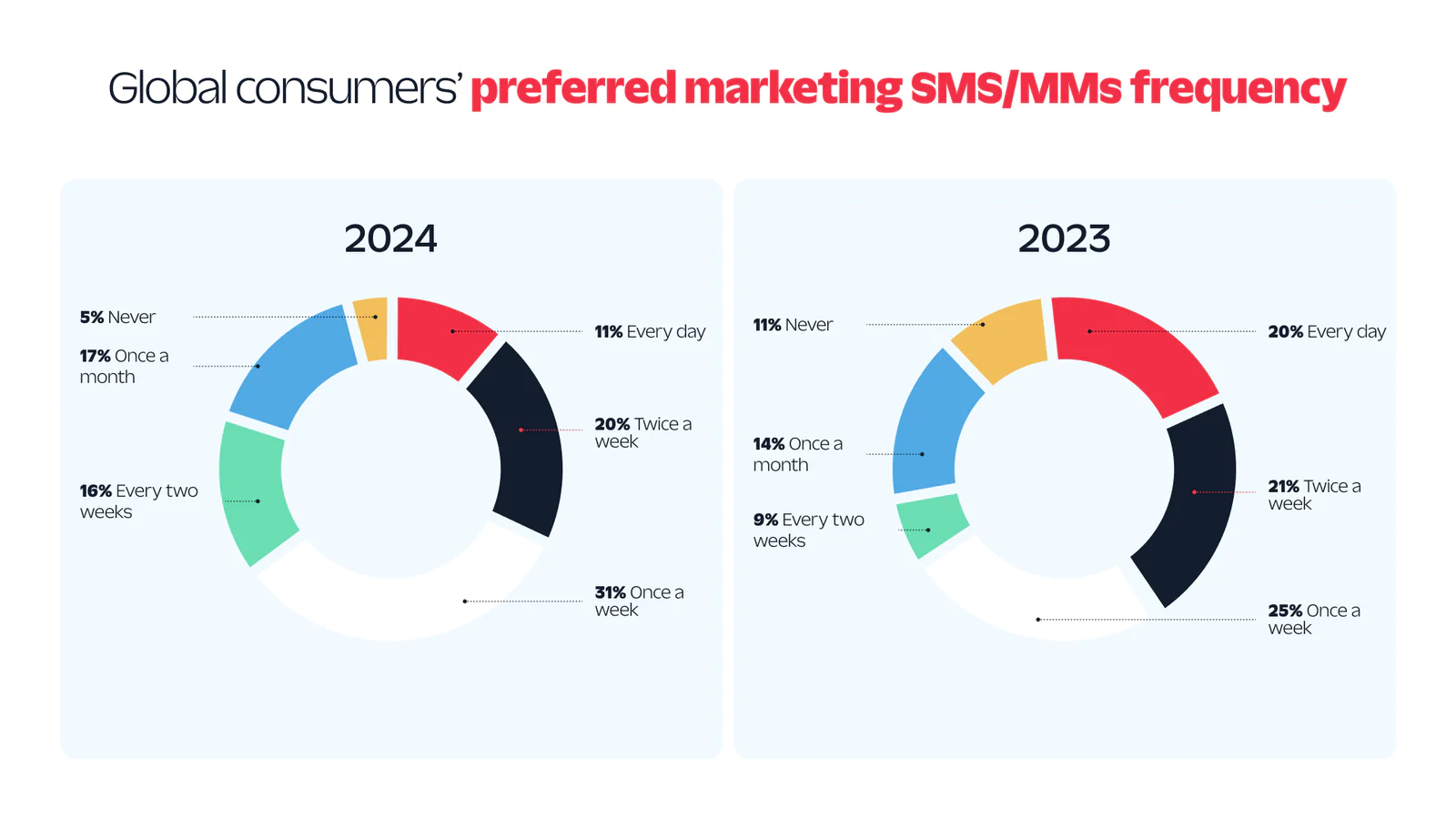

Last year, 31% of global consumers wanted to receive emails daily from their favorite brands, but today, daily emails are losing their appeal. In 2024, only 20% of consumers are interested in daily emails. Instead, most customers prefer weekly contact by email (30%) and SMS (25%).

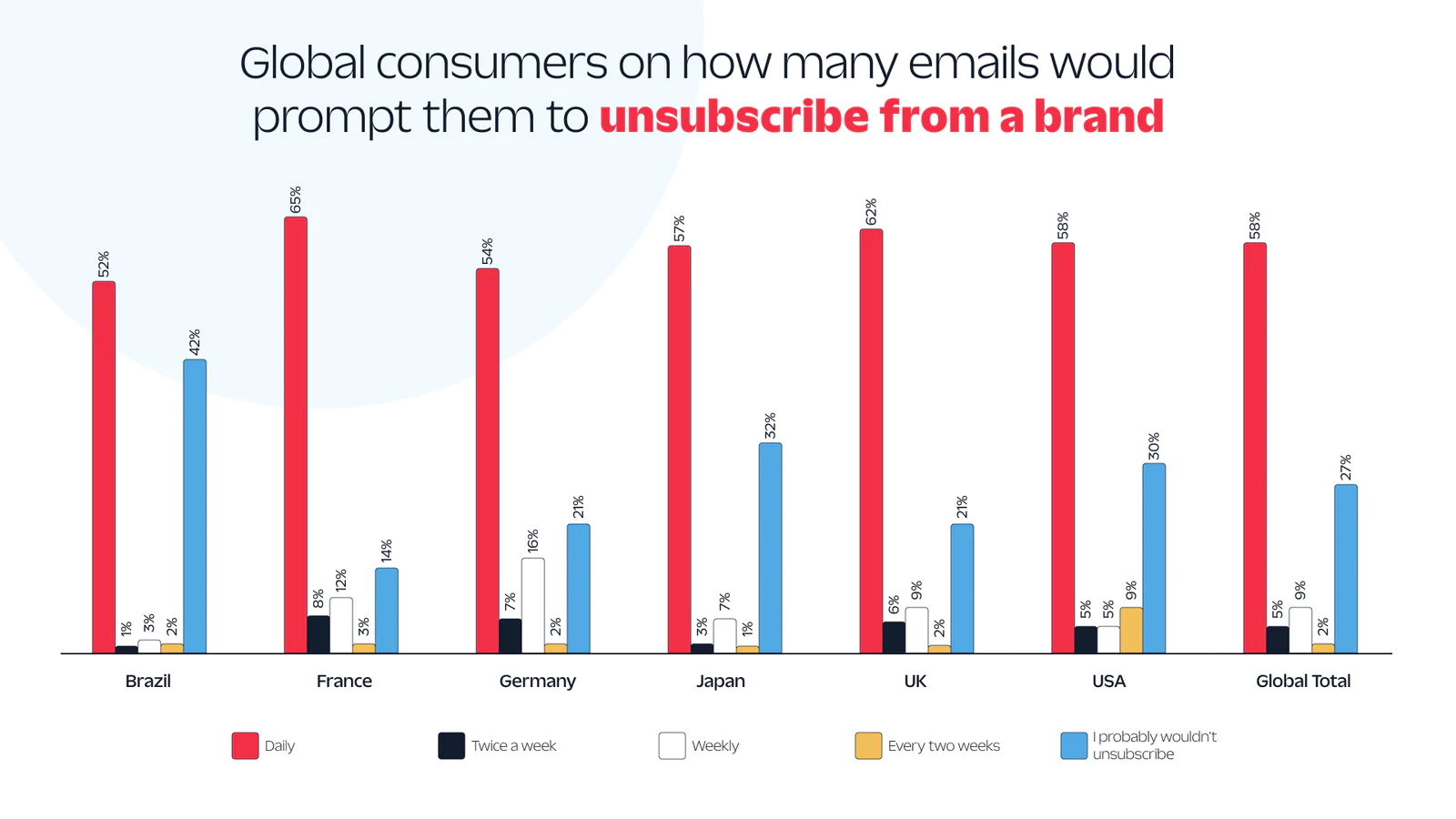

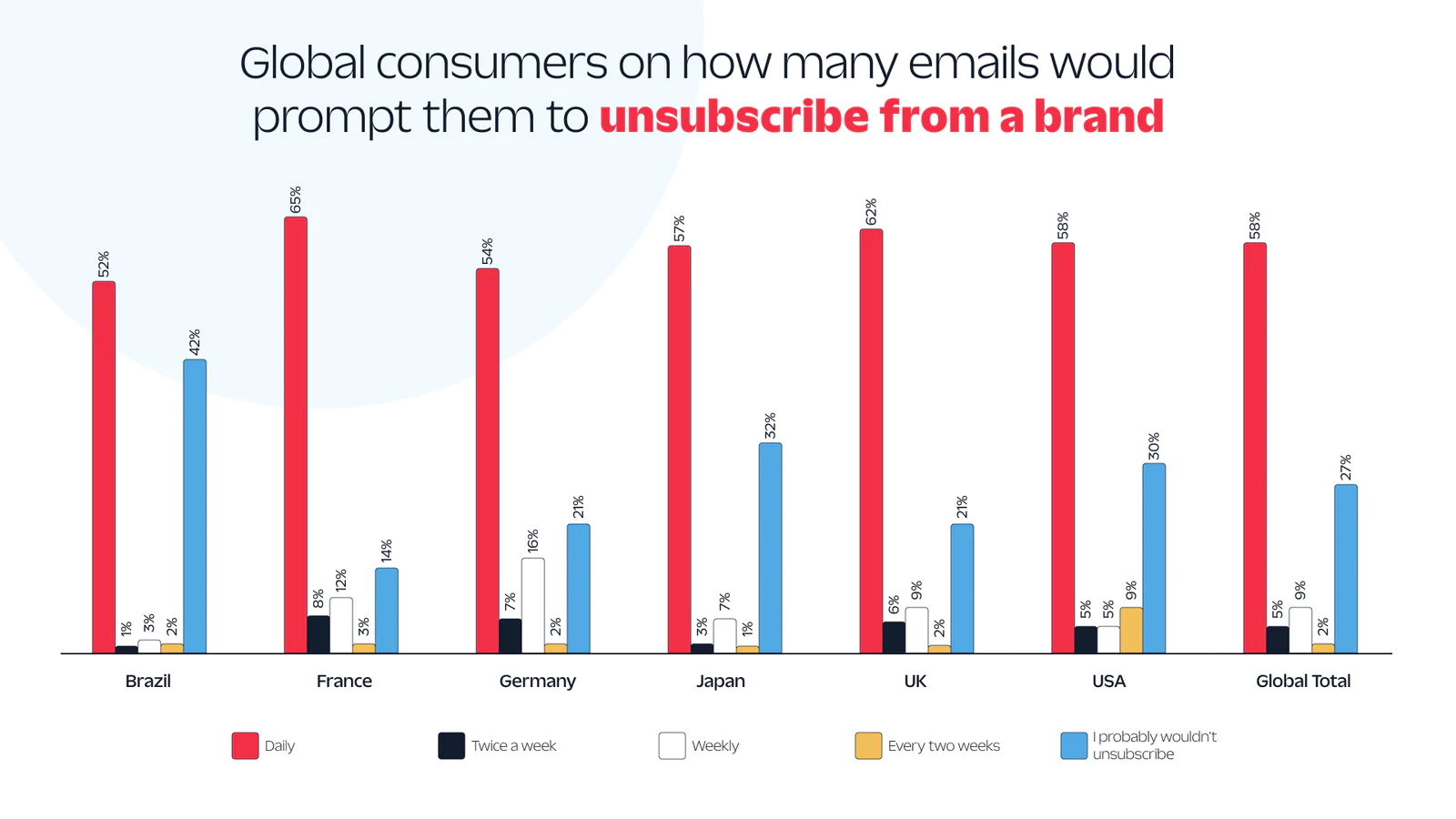

Because 53% of global consumers said they would unsubscribe if they received branded emails daily, it’s important to tread lightly. If you’re emailing your recipients every day, try pulling back your send frequency, or at the very least, be sure every message you send provides value to your customers so you don’t accidentally push them out the door.

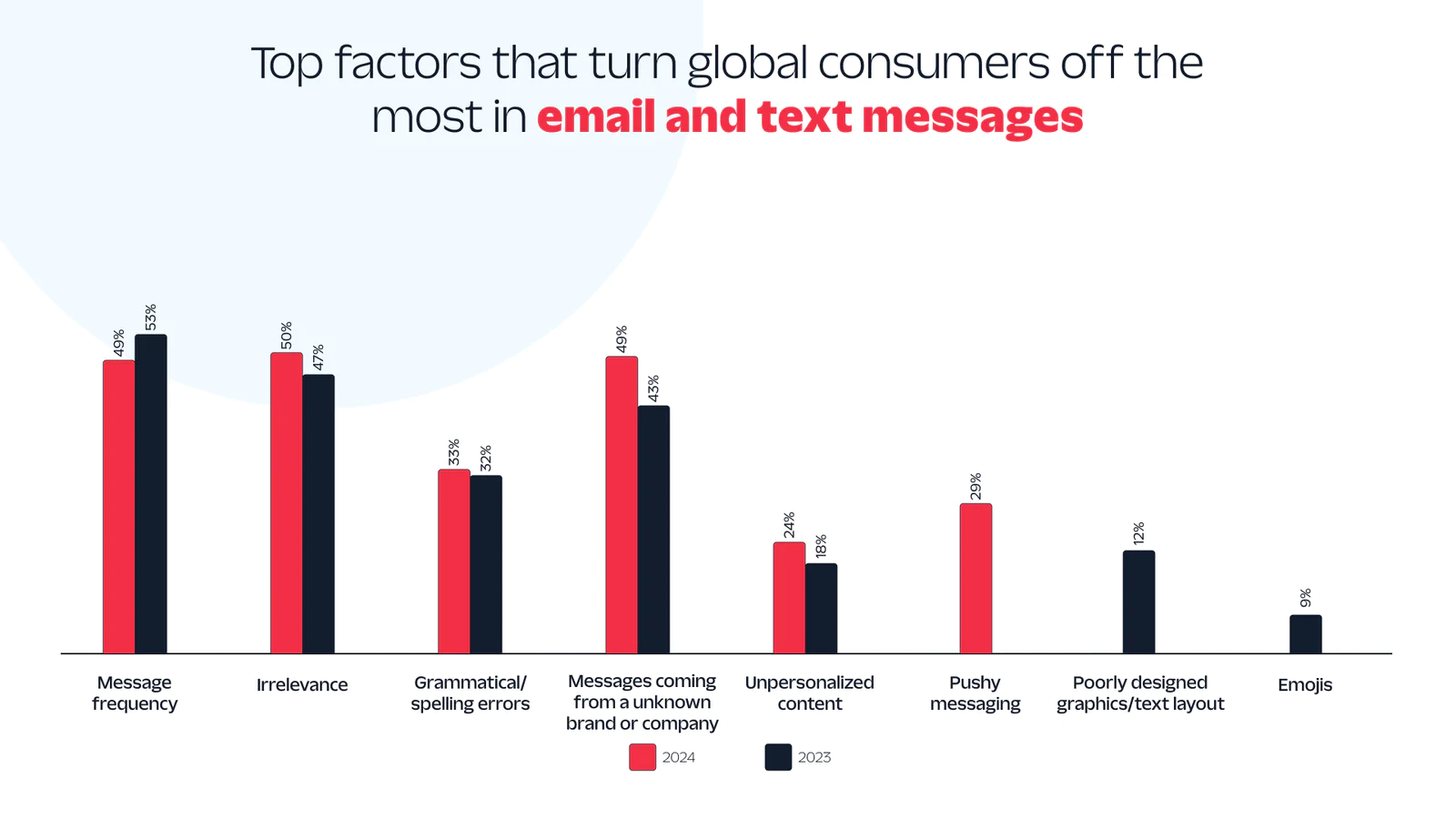

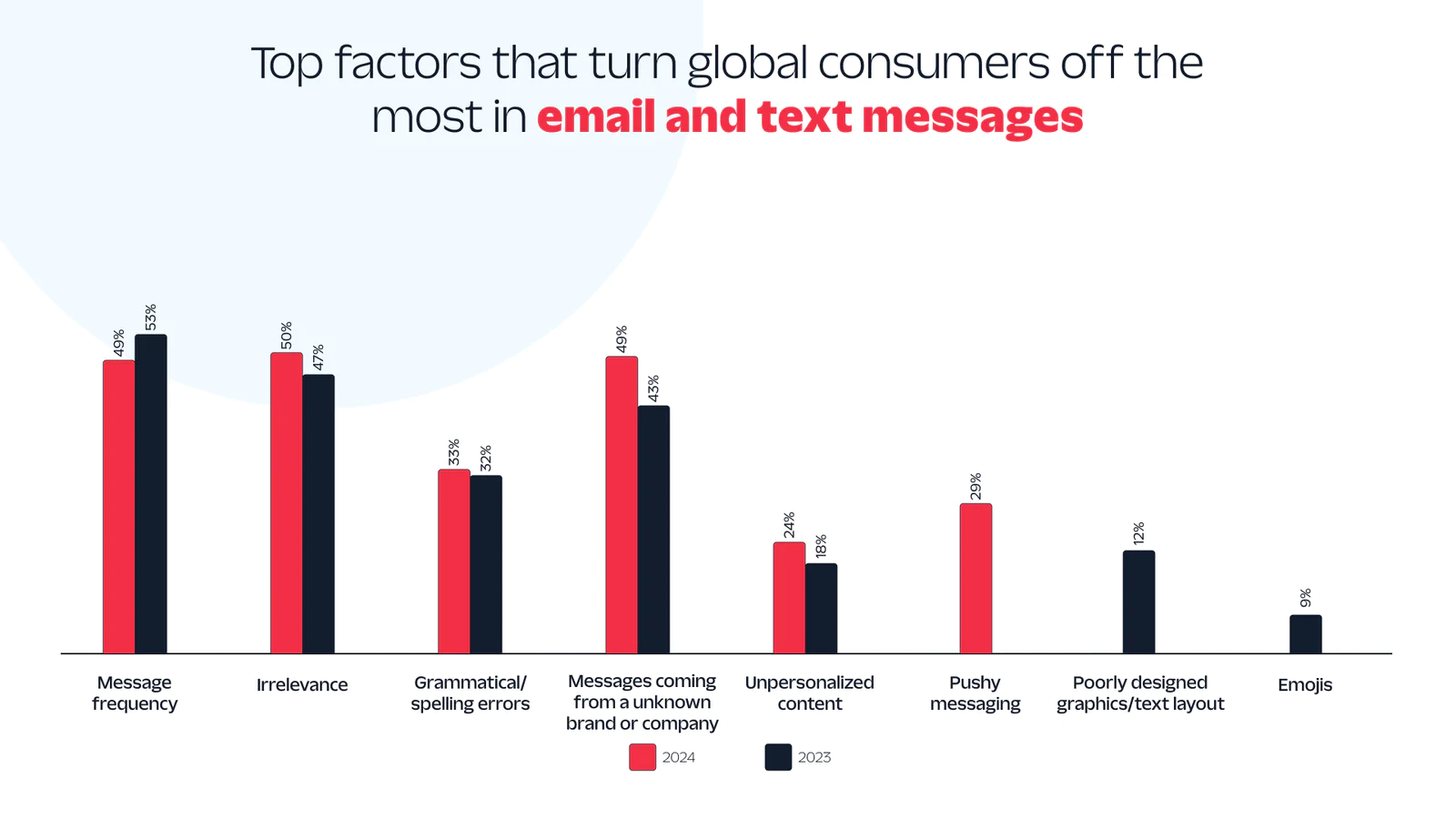

Naturally, not every email or text message will be well received. In fact, most consumers agree there are three key factors that make branded messages unwelcome.

Top factors that turn global consumers off from email and SMS/MMS

|

|

SMS/MMS |

|---|---|

|

|

We asked consumers to share their inbox frustrations. The top grievances? Messages from unknown senders (53% for both email and SMS) and irrelevant or uninteresting content (44% for both email and SMS). Each channel has its unique irritants as well: email users dislike receiving messages from brands they never subscribed to and continuing to get emails even after unsubscribing, while SMS recipients are frustrated by not immediately knowing who a message is from.

Our key takeaways? Avoid sending excessively, use an email preference center to allow subscribers to control what content they receive from you, and make it obvious a message is coming from your brand. This can help reduce unsubscribes, ensure your recipients find your messages engaging, and build trust with consumers.

To capture and maintain consumer interest in such a competitive communications landscape, your business needs to send clear and transparent messages. The first step? Use a clear sender name and email address in each of your messages. Clearly stating your brand’s name and using its logo and branding builds trust. It also ensures that consumers feel informed and confident in engaging with your communications.

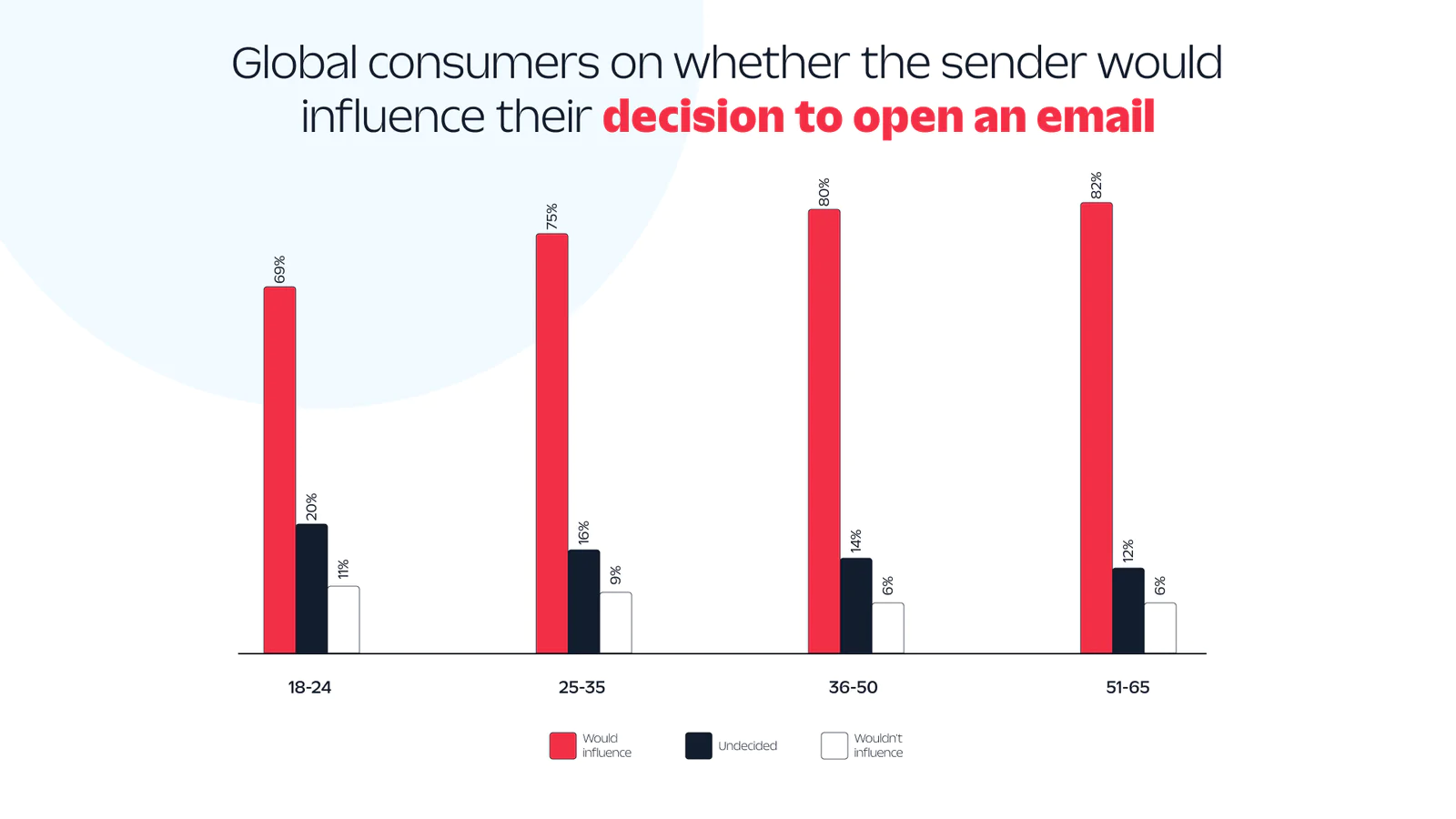

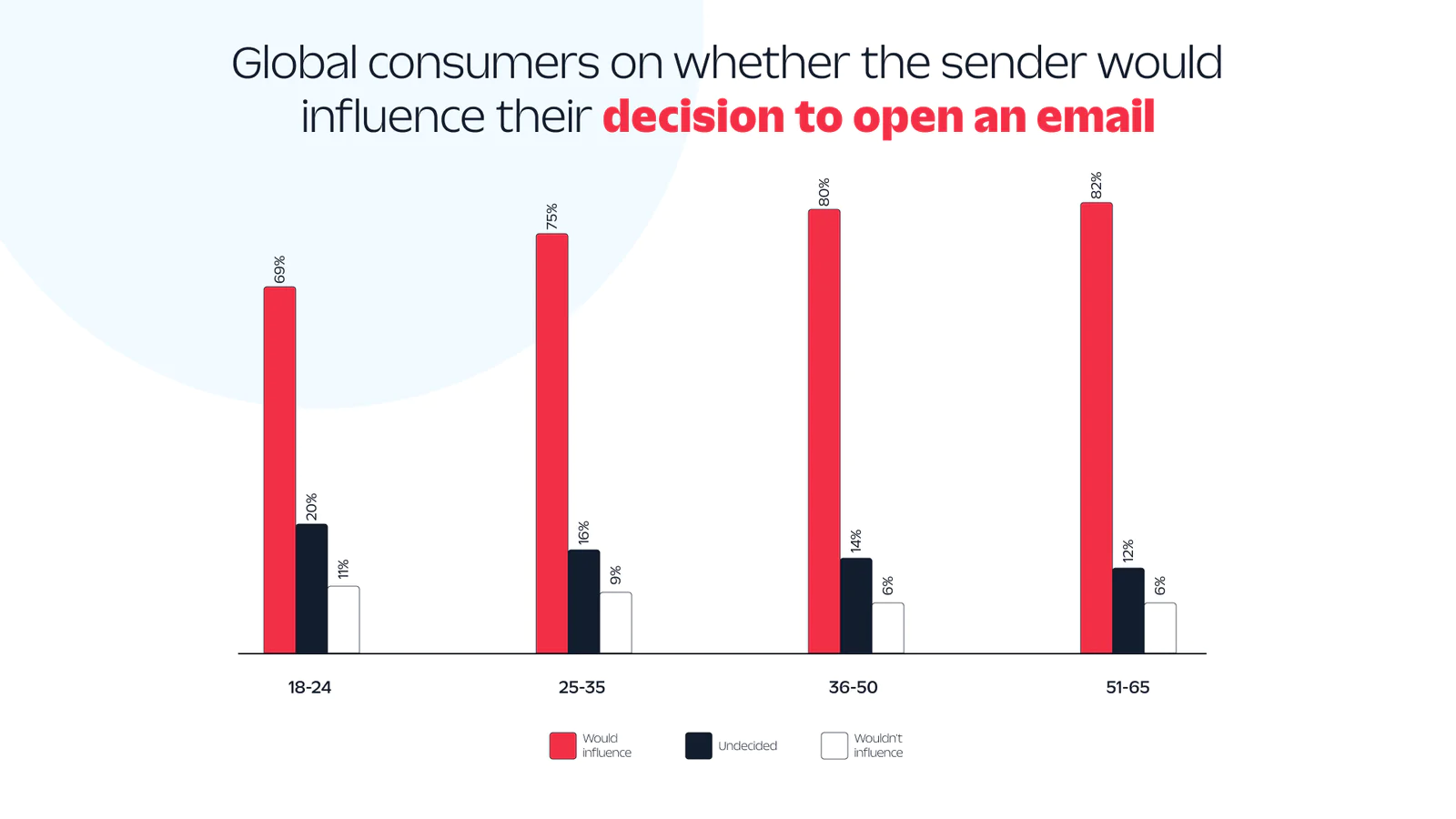

In fact, 77% of global consumers say the sender would strongly or somewhat strongly influence their decision to open an email. This factor is even more significant among older generations: 82% of 51-65 year olds and 80% of 36-50 year olds consider the sender when deciding whether to open an email. In contrast, only 75% of consumers aged 25-35 and 69% of those aged 18-24 feel the same.

A clear email sender is also one of the key ways consumers say brands can earn their trust. According to 20% of respondents, brands earn their trust when they use a clear email email address and sender name. This helps recipients quickly scan their inbox and decide if a message is worth their time.

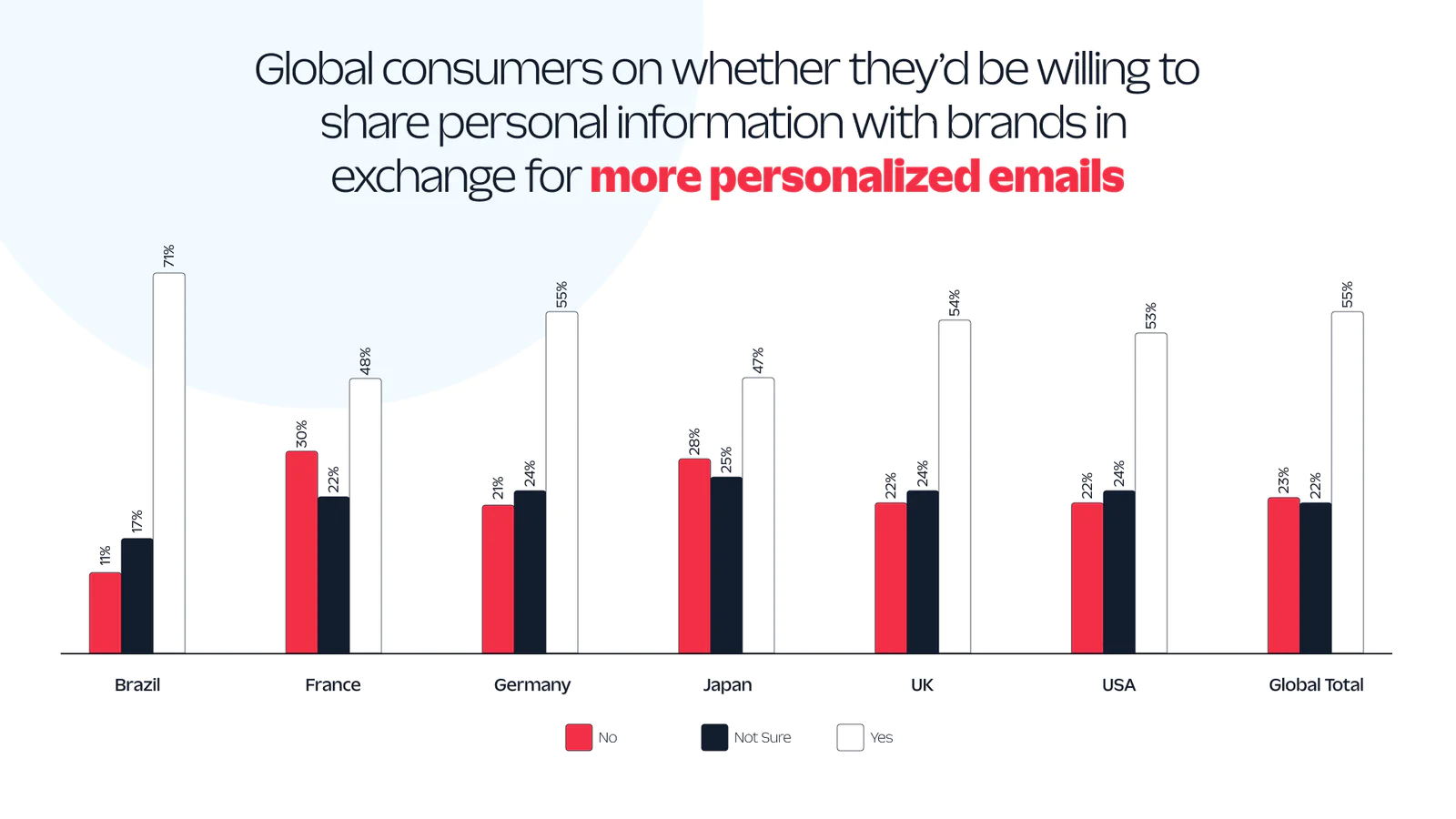

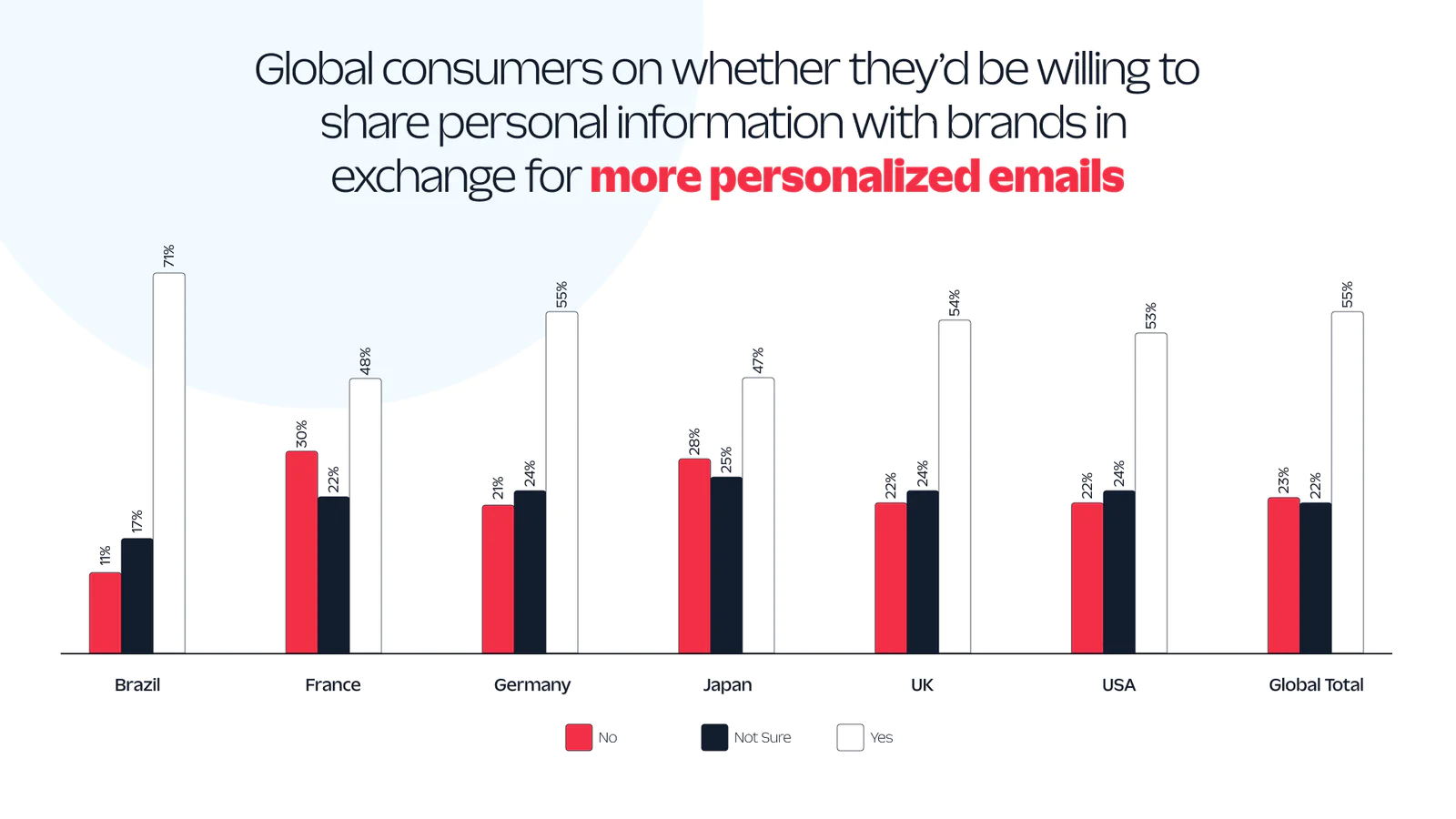

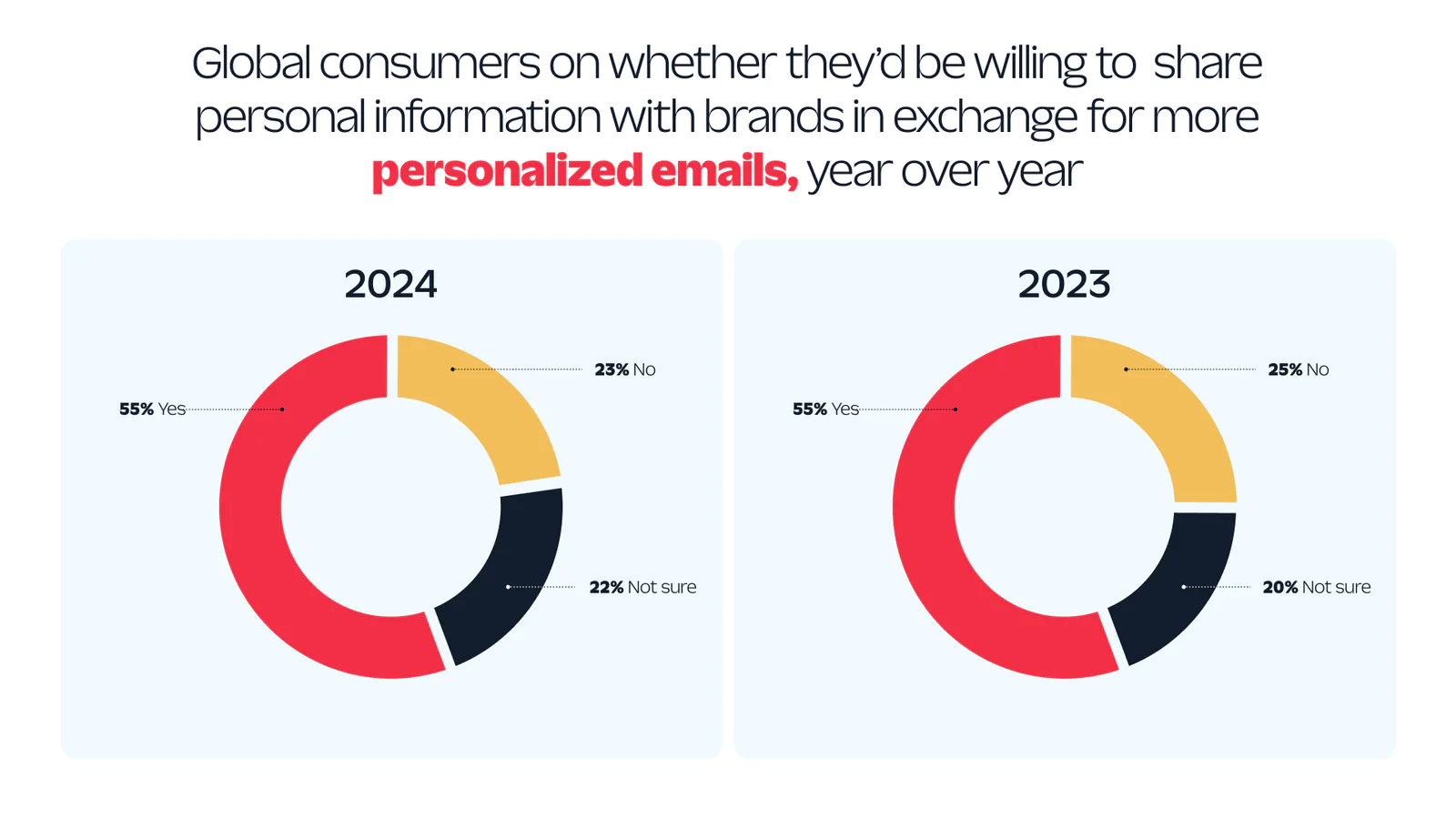

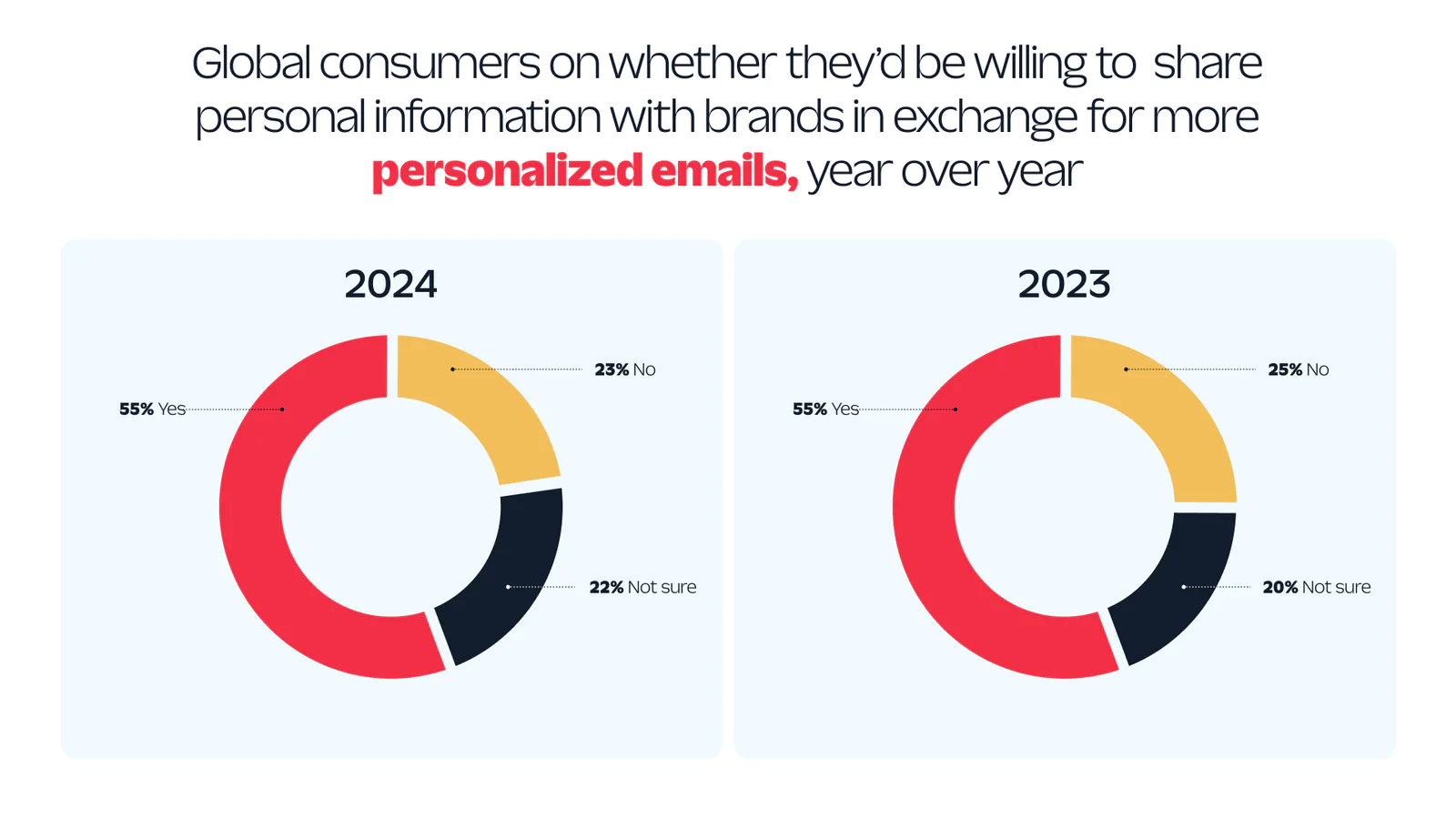

While 64% of global consumers believe personalization makes an email extremely or somewhat memorable, and 28% say personalized content is a key reason they subscribe to an email list, many are still hesitant to share personal information with brands in exchange for more tailored email content. The percentage of consumers willing to make this exchange remains at 55%, unchanged from last year.

Of all the countries surveyed, Brazil was the most open to the swap, with 71% of respondents saying they would share their personal data with brands and only 11% disagreeing. Japan, on the other hand, was the least open with only 47% being open to the idea.

Interestingly, these figures have remained relatively stable since last year, with only a two percentage point shift of respondents moving from "No" to "Not Sure."

On the SMS front, 49% of global consumers were willing to share their data for more targeted text messages. Unlike email, respondents had more polarizing views about this exchange when it comes to SMS. While only 23% of consumers rejected the offer for more email personalization in exchange for data sharing, 32% said “No" for SMS/MMS.

In Brazil, email remains the most popular communication channel for consumers. However, contrary to our global findings, social media ads have surpassed SMS in popularity, which now falls to third place in Brazil. While email and SMS are more favored by older generations, social media ads enjoy widespread popularity among consumers aged 18 to 50.

To better understand these preferences, we explored the underlying factors that influence Brazilians’ positive and negative feelings toward email and SMS messages.

For the second consecutive year, Brazil’s consumers were the least likely to unsubscribe due to email message volume. Globally, only 27% of respondents said no messaging frequency would push them to unsubscribe, while 42% of Brazilians said the same.

Of course, over half of Brazilians disagree, revealing that daily emails would push them to remove themselves from a brand’s email list. Fortunately, that was the only email frequency they found bothersome—sending emails just twice a week would prompt only 5% of Brazilians to unsubscribe.

Brazilians crave personalization. In fact, 72% said customization makes an email very or somewhat memorable. But what types of personalization do Brazilians prefer in their emails?

Content relevant to their interests (81%)

Personalized product recommendations (57%)

Content relevant to their location (36%)

Brazilians remain the most willing to share personal information for personalized content, with 72% open to the exchange, compared to just 55% across all surveyed countries.

Ever question the ROI of your email or SMS program? It turns out you might not need to.

Brazilians were more likely than respondents from any other country to reveal they’ve made a purchase based on content in an email, with an impressive 85% saying they’ve been influenced to buy—down just slightly from 87% in 2023.

While the urge to buy from SMS wasn’t quite as strong, 55% of Brazilian consumers still said they have pulled out their credit card in response to a convincing text message.

This year, email gained popularity in France, with 74% of consumers listing it as a top communication channel, up from 62% last year. In contrast, the appeal of SMS is waning, with customer preference dropping from 58% last year to 53% this year. Despite this decline, SMS still holds second place, as interest in social ads has remained constant since last year.

Let’s dive into these changing consumer preferences in more depth:

France was among the countries least likely to share their personal data in exchange for more customized emails and SMS messages. Globally, 55% of respondents were open to the idea for email and 48% for SMS, compared to only 48% and 43% of French consumers, respectively.

Despite their preferences, French consumers still desire personalization in branded messages. In fact, 65% of respondents stated that personalization makes an email very or somewhat memorable. Without consumers voluntarily sharing their information, businesses will need to learn about their customers through alternative methods, such as browsing data, past purchases, and other sources.

Most French email and SMS subscribers are looking for deals and discounts worth their while. When we asked French respondents why they subscribe to branded communications, the top reason was to stay informed about sales and discounts—68% for email subscribers and 55% for SMS subscribers. Additionally, 52% subscribe to a brand's emails for a first-purchase discount, while 40% do so for SMS.

To better understand what keeps subscribers engaged after signing up, we asked French consumers about the types of content they prefer to receive from their favorite brands. Again, content about deals and discounts was the clear favorite, with 57% of consumers listing it as a preferred content type for email and 45% for SMS.

While French consumers reported preferring to receive most content types via email, appointment confirmations and reminders were the only exceptions. When it comes to appointment reminders, 37% of French consumers preferred to receive these updates via text messages, compared to 34% who would opt for email.

Another reason to tread lightly in your French recipients’ inboxes is that French consumers are the most likely to unsubscribe from an email list if they start receiving messages daily from a brand. In the last year, this figure has risen from 60% to 65%.

Fortunately, when we asked French consumers what they find most bothersome about their email inboxes, the frequency of messages they receive was actually the lowest on their list, with only 25% of respondents indicating this was a major frustration. Instead, spam messages (48%), getting messages from brands they never subscribed to (41%), and continuing to receive messages after they unsubscribed (39%) were their top grievances.

This is a reminder to never buy email lists. You should only email recipients who are expecting to hear from you and promptly remove unsubscribed email addresses from your lists. This will keep your engagement scores high and ensure your messages don’t accidentally alienate your recipients.

Germany and Japan are the only countries where SMS doesn’t rank among consumers’ top three communication channels. Email remains Germany’s most popular choice with 64% listing it as a top channel, followed by social media ads at 42%. Video streaming ads and search engine ads tie for third place, each preferred by 32% of consumers. SMS comes in fourth, with only 29% of Germans listing it in their top three preferred channels.

Read on to understand more about German consumers’ unique messaging preferences:

Last year, 54% of Germans wanted to hear from their favorite brands via email twice a week or more. This year, that number fell to 42%. The new, most popular email cadence is just once a week, with 31% of consumers revealing that’s how often they’d like to hear from brands.

Interestly, Germans' tolerance for more frequent SMS messages actually increased this year. In 2023, 41% of consumers said they’d welcome texts twice a week or more, while this year that number grew to 46%. Most Germans only want to receive emails once a week, but the highest percentage of recipients (28%) were open to getting text messages twice a week.

More than half (57%) of Germans say that personalization makes an email very or somewhat memorable. So how can you use personalization to stand out in crowded consumer inboxes? The top use of personalization Germans appreciate is content relevant to their interests (67%), followed by personalized product recommendations (48%).

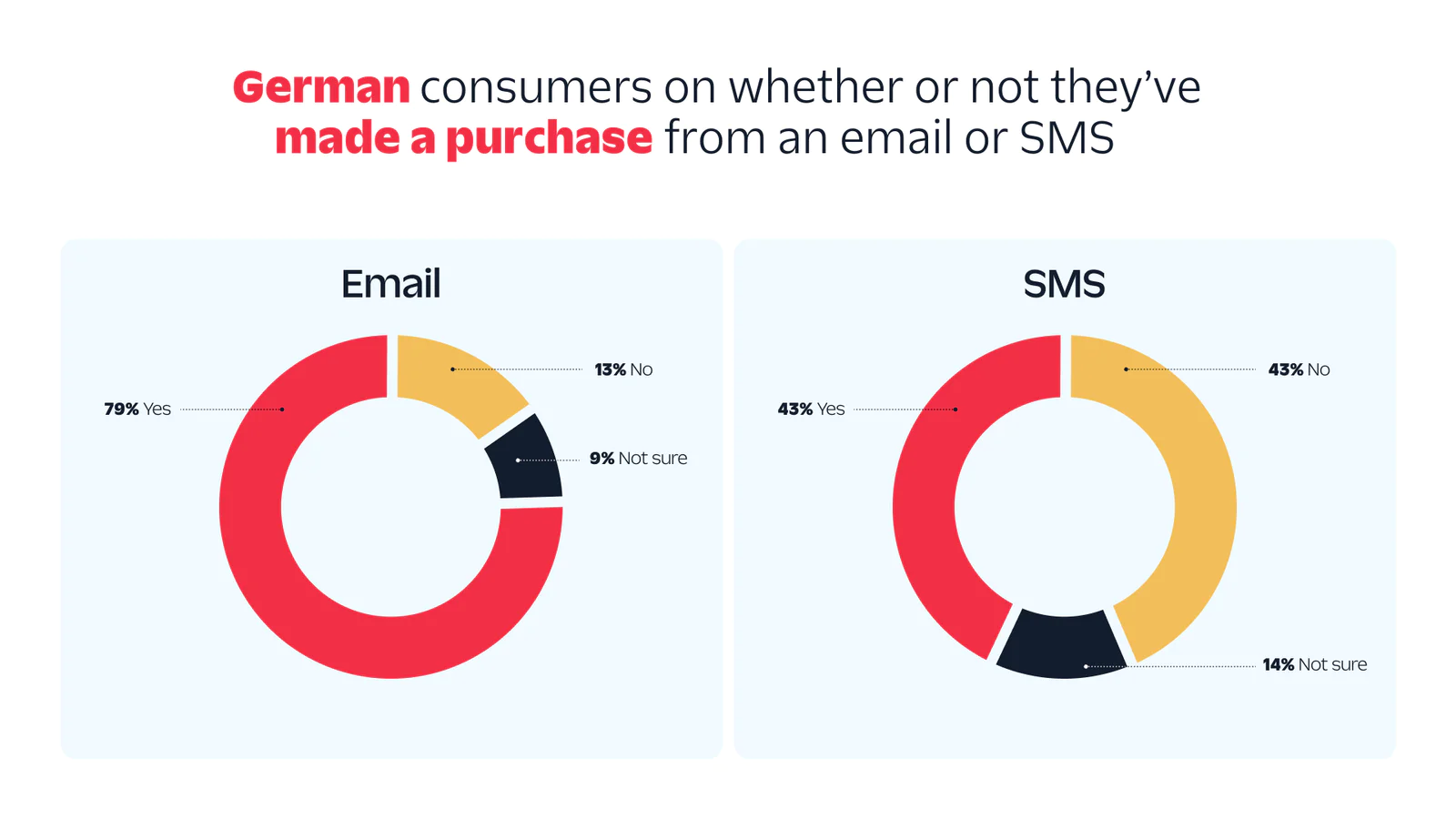

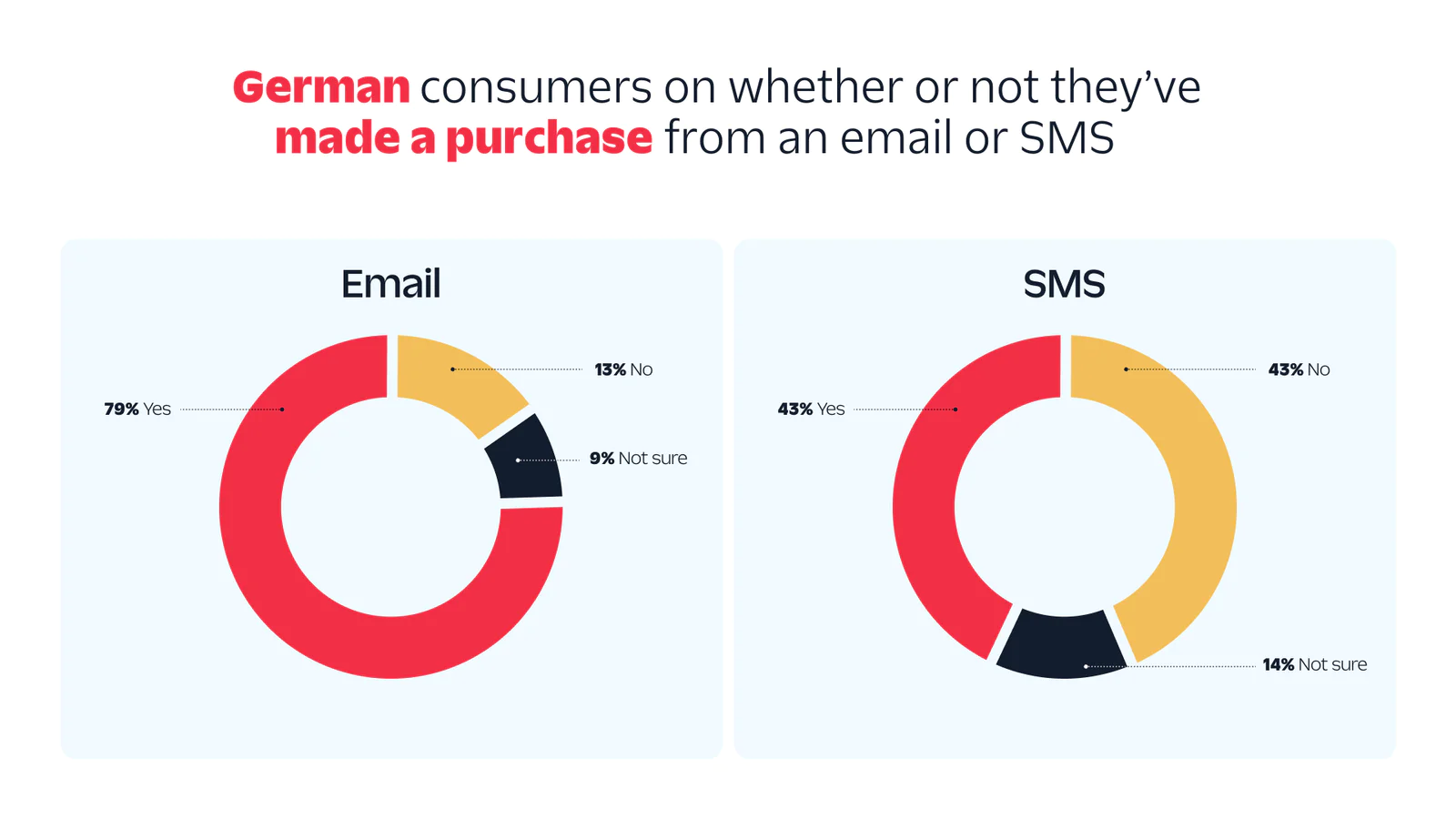

After Brazil, Germany had the highest number of consumers who’ve made a purchase from an email. Almost four out of five consumers have bought a product or service prompted by an email they received. On the other hand, SMS messages seem to be less persuasive to German consumers, as only 43% of them have bought something due to a text.

Similar to Germany, SMS doesn’t rank in the top three communications channels in Japan. Instead, it’s outperformed by video streaming ads—which 39% of consumers listed as a preferred channel—and both social media ads and push notifications, which were listed by 37% of respondents.

It’s important to note that popular messaging platforms like WeChat and Line, widely used in Asia, might not have been accurately represented in this survey. As such, these results may not fully capture the impact of these regional messaging apps in Japan.

Last year, when we asked Japanese consumers if they’d ever been influenced to make a purchase from an email, only 64% said they had—the lowest percentage across all countries surveyed. In fact, 30% said they’d never been influenced to buy based on an email message.

This year, the results were quite different. Email marketers, rejoice! Email driven purchases in Japan increased from 64% to 77% in 2024.

We also examined purchasing behavior related to SMS/MMS. As expected, Japanese consumers are less likely to buy something from a text message compared to an email. Nevertheless, 59% of respondents said they have been prompted to buy from a text. This was the second highest percentage across all countries surveyed—with the US leading slightly at 61%. Clearly, email and SMS are powerful channels that drive conversions in Japan.

Like in other countries, the main reason Japanese consumers subscribe to branded messaging is to stay informed of sales and promotions. But when we asked consumers what content they prefer to receive over these channels, the responses were notable. Shipping updates and delivery notifications were the most popular content type across both email (65%) and SMS (51%) in Japan. While receiving shipping updates was a key secondary factor in many countries, Japan was the only country that listed it first for both channels.

Aside from shipping updates, Japanese consumers preferred the same content types from both email and SMS messages. Critical information was the next most popular content type, followed by sales and discounts.

In every country surveyed, consumers indicated that the best way for brands to build trust is by having a clear email address and sender name—except in Japan. In Japan, 36% of consumers said that giving them the ability to choose which emails they receive is the most effective way to earn their trust. This preference was secondary in most other countries.

If you’re looking to win over Japanese email subscribers, make sure you have an email preference center. This allows them to opt in and out of specific email content, giving them control over what information they receive and how frequently they hear from your brand.

This year, both email and SMS gained popularity in the United Kingdom. Email was listed as a top preferred channel by 74% of UK respondents, up from 69% last year. SMS also saw an increase, with 46% of respondents including it as a preferred channel, up from 41% in 2023. Interestingly, the popularity of social media ads declined this year, with only 42% of consumers listing it as a preferred channel, down from 46% last year.

Let’s dive into some other interesting findings from this region:

As we mentioned earlier, global consumers’ tolerance for daily messages is fading fast—and the US and UK are at the forefront of that decline. In the UK, 50% fewer consumers were open to receiving daily text messages, down from 14% to 7% this year. While a once-a-week cadence is still the most favored by consumers, a growing number of respondents are interested in even less frequent messages. In fact, the second most popular SMS frequency is just once a month, with 24% of consumers in favor of this schedule.

It’s a similar story for email in the UK. In 2023, 53% of consumers wanted to hear from a brand more than twice a week. This year, that number has fallen to 39%. Similar to SMS, the majority of UK email subscribers (31%) want to hear from a brand just once a week, although more consumers are gravitating toward even less frequent messages to their inboxes.

As a sender, ensure you’re not overwhelming your audience with too many messages. Focus on sending content that your subscribers will find relevant and valuable.

Modern inboxes are full of brands vying for customers’ attention, but not all senders act in good faith. In fact, 54% of UK consumers list spam messages as a top frustration in their email inbox.

Looking to earn UK consumers’ trust? Start by using a clear email address and sender name.

We asked UK respondents to list the top reasons a brand would earn their trust in brand messaging, and having a clear email address and sender name topped their list. About 27% of UK respondents listed these key factors as the most important things a brand can do to earn their trust, followed by allowing them to choose how frequently they hear from your brand.

While 54% of UK consumers said they’d be willing to share more personal information with brands for more tailored emails, they were less open to doing the same for SMS. In fact, the UK had the fewest respondents open to this exchange for text messages, with only 42% willing—compared to 48% globally.

While email took gold in 2024, SMS edged out social media ads to become America's second most preferred communications channel this year. Although there wasn’t significant movement across other channels, US consumers demonstrated a growing fondness for push notifications, which grew from 20% to 28% this year.

To better understand these changing user preferences, read on.

While receiving too many emails from brands is a top turnoff for Americans, 46% of US consumers say their preferred email delivery frequency is more than twice a week. This is down from 65% in 2023—a 29% drop in just a year.

What’s the sending sweet spot? We discovered that 27% of consumers say they want emails just once a week, and 31% of respondents felt the same way about SMS. Of course, consumers might be more willing to hear from your brand more frequently if you deliver quality, personalized content that adds value to their inboxes. While communicating too often with your subscribers can frustrate them, engaging messages can build lasting relationships.

Still, brands should consider landing in consumer inboxes a privilege, not a right. In fact, 58% of Americans say they’d unsubscribe from an email list if a brand started emailing them every day—up slightly from 55% in 2023.

In our 2023 survey, 31% of US consumers said personalization would make an email very memorable, while this year, 41% expressed the same sentiment. Brazil still places the most importance on personalization out of any country surveyed, but the US is quickly gaining ground. This trend highlights the growing expectation among US consumers for tailored and relevant communications from brands, making personalization an essential strategy for businesses looking to enhance engagement and loyalty.

Since the term personalization includes a wide range of experiences, we asked US consumers to be more specific about what they expect from their favorite brands. Here were their top replies:

Content relevant to my interests (70%)

Personalized product recommendations (52%)

Content relevant to my location (37%)

While data privacy remains a top concern for global consumers, many are willing to part with their data in exchange for better experiences. In fact, 49% and 53% of Americans would be willing to share more information about themselves with brands in exchange for more personalized SMS messages and emails, respectively.

US consumers want brands to go beyond using their name in an email to tailor the content to their interests, past behavior, and location. Consumers are bombarded with messages daily. One key way to set your brand apart is to personalize content and ensure every message you send provides true value to your recipients.

If you can perfect your sending cadence and personalization tactics, email and SMS can become powerful revenue generators for your business. In fact, 78% of Americans say they’ve made a purchase based on content from an email and 61% said the same for SMS. US consumers had the highest SMS purchasing behavior out of any other country surveyed.

While purchasing over email is still more popular than SMS, SMS is a worthy channel to invest in, especially if some audiences are more comfortable with and responsive to marketing messages on their mobile devices. By leveraging the strengths of both channels and tailoring your approach to the preferences of your audience, you can maximize engagement and drive significant sales growth.

Email and SMS remain highly effective marketing channels worldwide. To maximize their potential, keep the following tips in mind:

Don’t spam recipients. Practice good list hygiene by promptly removing unsubscribed contacts to avoid annoying your recipients. Be sure to organically grow your subscriber lists too—never purchase a contact list.

Avoid oversending. Consumers are inundated with messages every day, so only send them emails and texts that provide concrete value. Better yet, use a messaging preference center to allow consumers to choose how frequently they hear from your brand.

Experiment with personalization. Global consumers want personalization, and many are willing to share more about themselves with your brand to get it. Try using personalized content in your emails and SMS messages to boost engagement.

Get to know your unique audiences. Every audience is different. While this survey provides country-specific insights and behaviors, remember that your customer base has its own unique characteristics. Collect and act on your own data for the best sending results.

Ready to start sending more personalized email and SMS messages your customers love? Start sending emails with Twilio SendGrid for free, and engage your audiences around the world. Happy sending!

SendGrid helps you focus on your business without the cost and complexity of owning and maintaining an email infrastructure. And with a full-featured marketing email service that offers a flexible workflow, powerful list segmentation, and actionable analytics, all of your email needs are met in one simple platform.